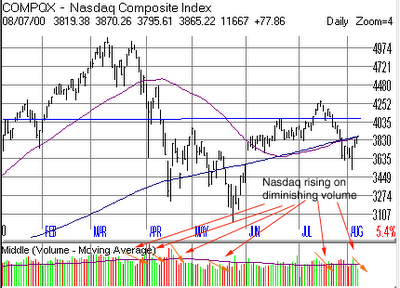

All three major indexes, DOW, NASDAQ, & S&P have been wedging higher. That is, rising while volume has been drying up. What does this mean to you? Even though the markets have been rising, the conviction of institutions to fully commit has been lacking. Without them, the current rally doesn't stand a chance.

Also interesting, the short ratio topped out almost at the same time the market started to rally in early June. Enforcing the idea that the current rally was nothing more then a short squeeze. The bull/bear and put/call ratios also never saw the extremes that these ratio exhibits when firm bottoms are made, and the DOW and NASDAQ are below their 200 day moving averages.

Also interesting, the short ratio topped out almost at the same time the market started to rally in early June. Enforcing the idea that the current rally was nothing more then a short squeeze. The bull/bear and put/call ratios also never saw the extremes that these ratio exhibits when firm bottoms are made, and the DOW and NASDAQ are below their 200 day moving averages.

Right now is a good time to be cautious. There are a lot of contrarian indicators pointing to further declines in the markets, but look for upcoming economic numbers to potentially add fuel to this rally. The market should rally strong if the economic numbers are good. If they don't, then put the red flag up, and start waving it.

The market has now entered it's worst three months of the year. If the past is any indication, then don't look for this current rally to materialize into anything more then a bear trap.

I have one prediction. If this rally is a bear trap and the market does sell off, look for a bottom to be put in late August or early September. Why? Everyone is on to the fact that the market has bottomed in October for the past few years. I believe that these people will sell off their holdings earlier in anticipation of the bottom, and position themselves back in stocks earlier to try and take full advantage of the bottom.

Good Luck!!

If you have to remember anything, remember the following:

Cut you losses short. Let your winners run, not your losers.

No comments:

Post a Comment