The market has rallied despite uncertainty surrounding Ukraine, Iraq, the economy, and upcoming earnings. Price action has been impressive, shaking out early in the day and closing higher or at the high's of the day on most days, but below average volume has been a major concern. Over the last two weeks, volume has expanded, still below average, but the market has failed to make much progress. Most of the higher volume days have either stalled or turned into a distribution day, higher volume selling. The lead index, the SP 500, has experienced four to five distribution days over the last three weeks, a major warning signal.

The NYSE advance/decline line continues to make new highs, but the fifty two week high low ratio has fallen despite the market trading at fifty two week highs...less stocks are participating in the upside. The VIX and bull bear ratios indicate extreme investor complacency, trading near bull market extremes. Interest rates have been falling and gold has been rising. A stealth attempt to rush to safety?

Leading growth stocks have lagged the entire rally. They have shown signs of life on several occasions, but have failed to sustain any momentum. Value stocks have been the clear leaders and the market has behaved accordingly, choppy and difficult to make progress in. Early breakouts have either become over extended, exhibiting climactic action, or lack volume, with many failing to make much progress. Relative strength has failed to confirm many recent breakouts, and most are late stage, wild and loose consolidations.

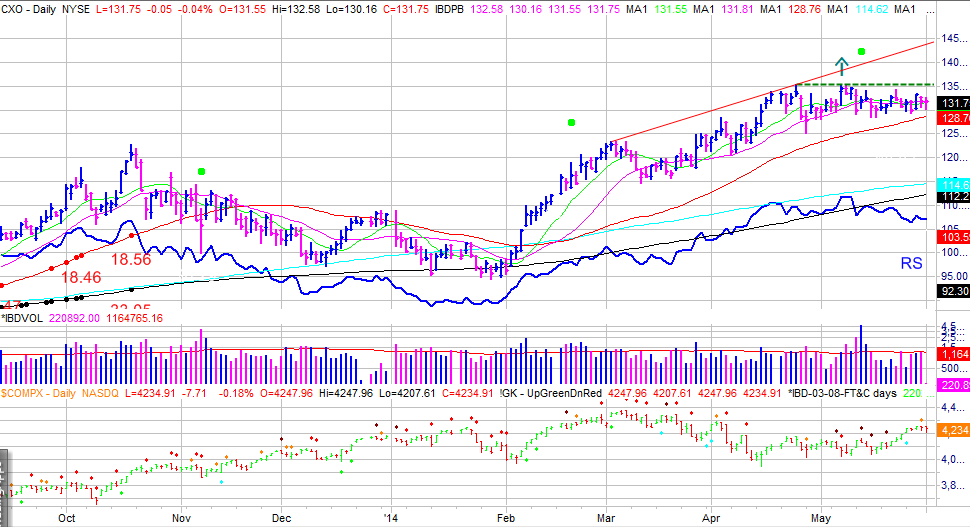

Netflix's (NFLX) handle has been wedging along the lows. Pacira Pharmaceuticals (PCRX) is a wild and loose, late stage breakout in weak volume. Celgene (CELG) broke out of a v-shaped cup and handle but the relative strength line has not confirmed. Hi-Crush Partners (HCLP) is extended historically and in the midst of a potential climax run, up over 25% in a few weeks after a long advance. Bidu (BIDU) and FaceBook (FB) have attempted to breakout from wild and loose cup and handle bases, but failed to make much progress and the relative strength lines are lagging. Home builders, Toll Brothers (TOL), Lennar (LEN), and Standard Pacific (SPF), have attempted to build cup and handle bases, but the relative strength lines have lagged and the consolidation are wild and loose. Oil and Gas stocks have been the clear leaders, Sanchez Energy (SN) and Pioneer Natural Resources (PXD).

The divergence between market direction and sell signals has become "normal" stock market behavior over the last year and a half, during rallies for short periods of time. But when the convergence begins, traders and investors had little time to react. Hard earned profits vanished and quickly turned into losses if traders hesitated to protect profits and minimize losses.

The market is in a perfect position to frustrate longs and shorts at the same time, slowly killing them from over trading, a death by a thousand cuts. Traders should be extremely selective with new positions and hold only well behaving positions. Without hesitation, protect profits in over extended positions, and book minor profits or minimize losses in lagging stocks. Better safe then sorry with all the sell signals.

The NYSE advance/decline line continues to make new highs, but the fifty two week high low ratio has fallen despite the market trading at fifty two week highs...less stocks are participating in the upside. The VIX and bull bear ratios indicate extreme investor complacency, trading near bull market extremes. Interest rates have been falling and gold has been rising. A stealth attempt to rush to safety?

Leading growth stocks have lagged the entire rally. They have shown signs of life on several occasions, but have failed to sustain any momentum. Value stocks have been the clear leaders and the market has behaved accordingly, choppy and difficult to make progress in. Early breakouts have either become over extended, exhibiting climactic action, or lack volume, with many failing to make much progress. Relative strength has failed to confirm many recent breakouts, and most are late stage, wild and loose consolidations.

Netflix's (NFLX) handle has been wedging along the lows. Pacira Pharmaceuticals (PCRX) is a wild and loose, late stage breakout in weak volume. Celgene (CELG) broke out of a v-shaped cup and handle but the relative strength line has not confirmed. Hi-Crush Partners (HCLP) is extended historically and in the midst of a potential climax run, up over 25% in a few weeks after a long advance. Bidu (BIDU) and FaceBook (FB) have attempted to breakout from wild and loose cup and handle bases, but failed to make much progress and the relative strength lines are lagging. Home builders, Toll Brothers (TOL), Lennar (LEN), and Standard Pacific (SPF), have attempted to build cup and handle bases, but the relative strength lines have lagged and the consolidation are wild and loose. Oil and Gas stocks have been the clear leaders, Sanchez Energy (SN) and Pioneer Natural Resources (PXD).

The divergence between market direction and sell signals has become "normal" stock market behavior over the last year and a half, during rallies for short periods of time. But when the convergence begins, traders and investors had little time to react. Hard earned profits vanished and quickly turned into losses if traders hesitated to protect profits and minimize losses.

The market is in a perfect position to frustrate longs and shorts at the same time, slowly killing them from over trading, a death by a thousand cuts. Traders should be extremely selective with new positions and hold only well behaving positions. Without hesitation, protect profits in over extended positions, and book minor profits or minimize losses in lagging stocks. Better safe then sorry with all the sell signals.