All year long, every time the market threatened to enter its first prolonged, deep correction, the market would stop on a dime, reverse, and run relentlessly back into new highs. Barely pausing to allow traders back into the market. And each time the market would make it back to new highs, leading growth stocks would start to stall and warn of another looming correction weeks before the market would actually rollover. Chopping hesitant traders to death.

Smart traders protected their portfolios rather then try and hold on in hopes of more upside after a prolonged bull run, and more and more bull market leadership climaxing, topping out, and failing to follow through to new highs with each successive high by the market.

So here we are at the end of the year, in the same place we have found ourselves so many times this year. The market rolled over at the beginning of December after several more bull market leading growth stocks climaxed and rolled over to slice their fifty day moving averages, only to reverse on December 17th, in massive volume, and run back to new highs within six days.

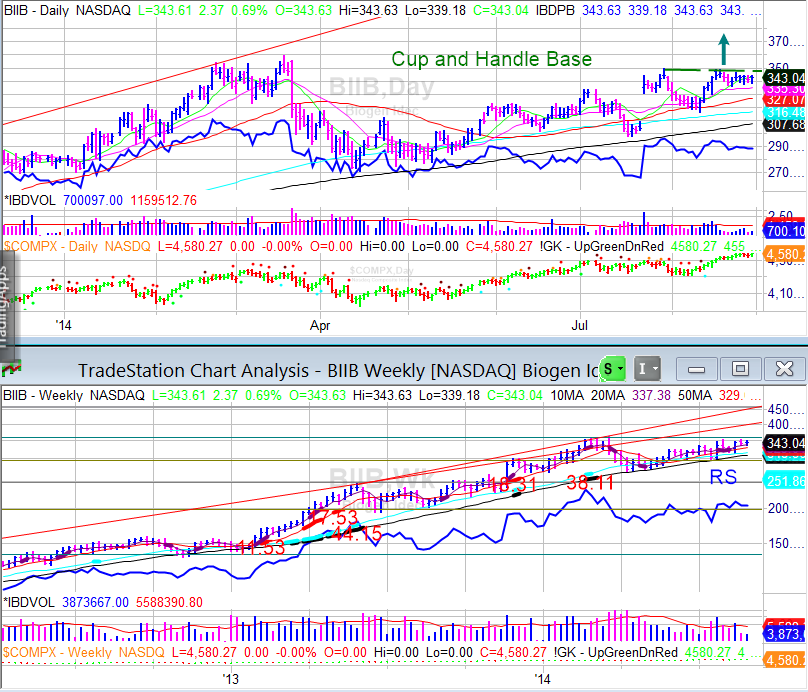

Once again, leading growth stocks that climaxed in the previous market move to new highs, have failed to follow the market higher, while a much narrower group of stocks, that have not crashed through their fifty day moving averages, stand ready to climax with this move back to new highs. The majority of these stocks are rising out of late stage, wide and loose consolidations, with lagging relative strength. And the the longer these stocks sit around in consolidations without breaking out to new highs, the more likely any breakout attempt will be a bull trap and fail, rather then follow through aggressively to new highs. A major red flag for the prolonged health of this leg of the bull market.

Shorting has not been any easier, except for in the commodities sectors. Oil, gas, gold, and silver related stocks have had several sustained down trends that nimble traders could have taken advantage of. The short trading ideas list, updated almost every week, has included dozens of these stocks throughout the year.

At this point, traders that reacted quickly with the last blog entry, Is a Christmas Rally Around The Corner, covered their short positions and avoided painful squeezes in the majority of these stocks, and are positioned long.

If not, as stated earlier, there are still some interesting trading setups in the leading growth stocks analysis list that have the potential to make big moves going into earnings or while the market is able to hold up. But keep in mind, the list is extremely narrow, and the few that have moved with the market have barely kept pace with rapid advance by the market since the December 17th bottom.

With all the major indices at or near all time highs, it would not be surprising if the bull market pushed ahead for another few weeks into earning's season. But with all the red flags that have existed for the past few months ever present, the market is clearly in a topping process that is taking longer then most traders and investors are used to. Traders should be on the lookout for further lagging action to aggressively tighten stops to protect profits and minimize losses on lagging positions.

Apple (AAPL) and Baidu (BIDU) are bouncing off their fifty day moving averages, Ali Baba (BABA) and Actavis (ACT) are attempting to bounce off their fifty day moving averages, Avago Techonologies (AVGO) has pulled back to the twenty day moving average and is three weeks tight, and Illumina (ILMN) is setup in a flat base on top of cup and double bottom handle.

The short side, except for a few stocks, needs time to tighten up after the major squeezes many of these stocks experienced recently. Until there is more distribution in the market, traders would be prudent to thread lightly on the short side.

Going into 2015 it is hard to predict a bear market is around the corner. The market rarely ever falls into a bear market without at least another major rally attempt to new highs.

With the third year of the presidential cycle historically bullish, it would not be surprising if the market fell into a multi-month, major correction, as we approach the Yellen "couple of meeting's" tightening schedule she alluded to at the last FED press conference (February or March). But the markets have historically only reacted negatively short term term as the FED begins its tightening cycle and continued to advance higher until the FED has raised rates at least several times.

In conclusion, based on historical precedents of the presidential cycle and FED tightening, I'm expecting the market to finish this rally at some point early next year and fall into a minimum of a 12 - 15% corrrection, to as much as 20% on forced liquidations. Resume the bull market for the remainder of 2015 and possibly 2016, at which point FED tightening and the Presidential race will take their toll on the market. With the Nasdaq so close to all time highs at 5,132.52, I would not be surprised if the market achieved this level before a bear market begins.

Of course the facts can change over that period and we will adjust our expectation accordingly. For now, we can only trade based on the facts that are currently present in front of us.

Good luck and happy new year if this turns out to be the last market update of the year.

Smart traders protected their portfolios rather then try and hold on in hopes of more upside after a prolonged bull run, and more and more bull market leadership climaxing, topping out, and failing to follow through to new highs with each successive high by the market.

So here we are at the end of the year, in the same place we have found ourselves so many times this year. The market rolled over at the beginning of December after several more bull market leading growth stocks climaxed and rolled over to slice their fifty day moving averages, only to reverse on December 17th, in massive volume, and run back to new highs within six days.

Once again, leading growth stocks that climaxed in the previous market move to new highs, have failed to follow the market higher, while a much narrower group of stocks, that have not crashed through their fifty day moving averages, stand ready to climax with this move back to new highs. The majority of these stocks are rising out of late stage, wide and loose consolidations, with lagging relative strength. And the the longer these stocks sit around in consolidations without breaking out to new highs, the more likely any breakout attempt will be a bull trap and fail, rather then follow through aggressively to new highs. A major red flag for the prolonged health of this leg of the bull market.

Shorting has not been any easier, except for in the commodities sectors. Oil, gas, gold, and silver related stocks have had several sustained down trends that nimble traders could have taken advantage of. The short trading ideas list, updated almost every week, has included dozens of these stocks throughout the year.

At this point, traders that reacted quickly with the last blog entry, Is a Christmas Rally Around The Corner, covered their short positions and avoided painful squeezes in the majority of these stocks, and are positioned long.

If not, as stated earlier, there are still some interesting trading setups in the leading growth stocks analysis list that have the potential to make big moves going into earnings or while the market is able to hold up. But keep in mind, the list is extremely narrow, and the few that have moved with the market have barely kept pace with rapid advance by the market since the December 17th bottom.

With all the major indices at or near all time highs, it would not be surprising if the bull market pushed ahead for another few weeks into earning's season. But with all the red flags that have existed for the past few months ever present, the market is clearly in a topping process that is taking longer then most traders and investors are used to. Traders should be on the lookout for further lagging action to aggressively tighten stops to protect profits and minimize losses on lagging positions.

Apple (AAPL) and Baidu (BIDU) are bouncing off their fifty day moving averages, Ali Baba (BABA) and Actavis (ACT) are attempting to bounce off their fifty day moving averages, Avago Techonologies (AVGO) has pulled back to the twenty day moving average and is three weeks tight, and Illumina (ILMN) is setup in a flat base on top of cup and double bottom handle.

The short side, except for a few stocks, needs time to tighten up after the major squeezes many of these stocks experienced recently. Until there is more distribution in the market, traders would be prudent to thread lightly on the short side.

Going into 2015 it is hard to predict a bear market is around the corner. The market rarely ever falls into a bear market without at least another major rally attempt to new highs.

With the third year of the presidential cycle historically bullish, it would not be surprising if the market fell into a multi-month, major correction, as we approach the Yellen "couple of meeting's" tightening schedule she alluded to at the last FED press conference (February or March). But the markets have historically only reacted negatively short term term as the FED begins its tightening cycle and continued to advance higher until the FED has raised rates at least several times.

In conclusion, based on historical precedents of the presidential cycle and FED tightening, I'm expecting the market to finish this rally at some point early next year and fall into a minimum of a 12 - 15% corrrection, to as much as 20% on forced liquidations. Resume the bull market for the remainder of 2015 and possibly 2016, at which point FED tightening and the Presidential race will take their toll on the market. With the Nasdaq so close to all time highs at 5,132.52, I would not be surprised if the market achieved this level before a bear market begins.

Good luck and happy new year if this turns out to be the last market update of the year.