This is going to be my communist pick of the year. Short Microsoft. Did I say that? Yes, short Mr. Softee!!! Why? It stinks, the chart is a mess, the fundamentals are a mess, and all this points to no where but down.

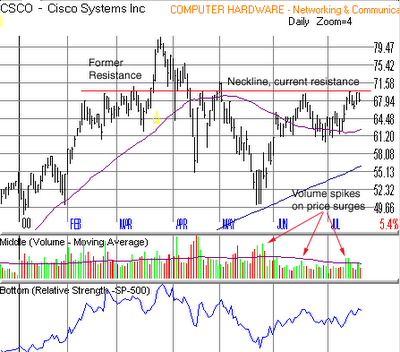

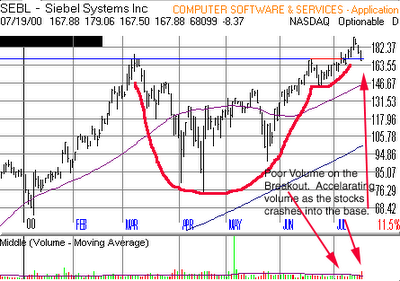

I wasn't this bearish on the stock a few days ago. In fact I was looking to go long, but how things change over the course of just a few days. The stock had put in an Island bottom, followed by a gap up on heavy volume into a flat base to consolidate its move from the low 60's, and looked like it was getting ready to attack the high 80's. But all that came crashing to a halt when the stock sold off and broke down out of its base on heavy volume after reporting earnings on 7/19. The stock has now formed an intermediate island top. The sell off today through the 50 day moving average and the declining relative strength make the stock an even better short and most likely will force MSFT to test its support level in the low 60's. I would be a short seller of the stock under 71.

The companies fundamentals aren't looking good either. For a stock that is supposed to be dominating the world, 13% revenue growth is quite paltry. Earnings? What a joke those are. The company has used realized gains from sale of investments to make them look good. So what you say? Your not buying the company because they are in the business of making investments for you. You buy them for their operations in software, which doesn't seem to be growing so fast anymore. Think about it this way, if the market were to crash, devaluing their investments, or MSFT sold out of all their investments, they would have nothing left to hide the poor performance of their software business. Realized gains are one time events. Once they are gone, they are gone unless you can keep making good investments. If that is what MSFT has become, then let them tell us that, and we'll value them as if they were a mutual fund, or an incubator, rather then a software company. Think about it another way. If the use of realized gains to make earnings look good was ok, then why weren't analyst pounding the buy recommendations on 7/19? Why weren't the mutual funds scooping it up at these bargain basement levels? The chart says it all, they want out. Don't believe the guest on CNBC when he says he loves MSFT at these levels. What is he supposed to say? I hate the stock I own 10,000,000 shares of and I want you to sell it so I can get killed. I don't think so.

The Justice Department is another thorn in their side. As long as the anti-trust case goes on, it will distract the company from doing what they have to do to stay as the top software company. There is no way they will be permitted to bundle any other critical piece of software with their operating system or make an acquisition that may strengthen them. Joel Klein will see that doesn't happen.

If you're skeptical about initiating a short right now, wait and see what happens. If the market turns northward, the stock may attempt to rally to the bottom of the base it broke down from at around 76. Watch the volume. If the stock does rally, but on light volume, then initiate the short on the day it stops moving higher and reverses.

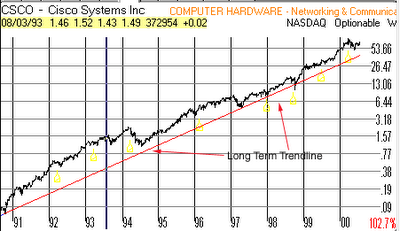

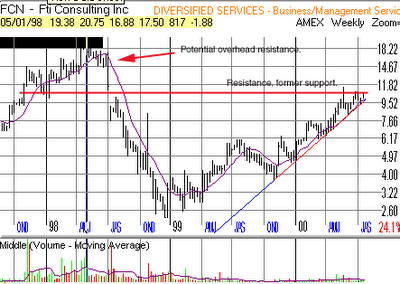

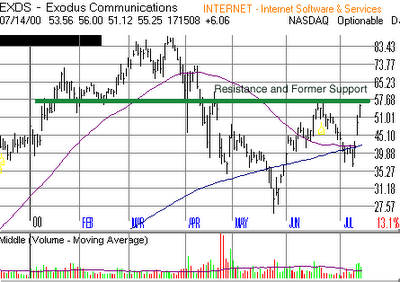

Here is a chart lesson for some of you. Notice on the chart below how the low 60's, the exact spot the stock found support at during its prior sell off, happens to be a resistance level the stock ran into back in 1998. It is always important to look back in time to see if you can identify spots where the stock will find some buying support, this will help you identify the potential fall after the stock has broken down. For long term investors, it could identify a spot to initiate a new position. For short seller it identifies a spot they may want to cover at. For traders it identifies a spot where the stock can bounce for a few point gain.

What if the stock breaks the support in the low 60's? Well if it comes on heavy volume, their is a minor support at around 55, the middle of a double bottom the stock formed in 1998, and a major support at 47, the bottom of the double bottom formed in 1998. Long term investors, good luck. Hey, you never know, I might just join you if the chart changes. That's the beauty of technical analysis, love them one day, hate them the next. And it's not always in days, in can be in minutes.

Just to let you know, I shorted the stock today at 71.

Remember: 7% stop losses from your buy point on all trades, or whatever you're comfortable with. Preserve your capital, and you will live to fight another day. Lose it, and back to mutual funds you go.

Remember: 7% stop losses from your buy point on all trades, or whatever you're comfortable with. Preserve your capital, and you will live to fight another day. Lose it, and back to mutual funds you go.