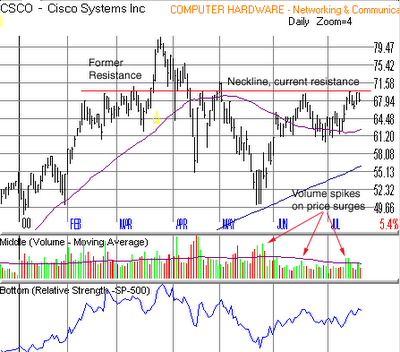

I got to say, CSCO is looking good here. It is in the process, actually at the end of forming a head and shoulders bottom pattern. Notice the spikes in volume on price surges, signaling accumalation. The bullish bottoming formation and the accumulation signals make CSCO a potential buy if it can break 69 7/8, the neckline of the head and shoulder pattern, on heavy volume, at least 50% greater then the 50 day moving average. Also, notice how the neckline acted a resistance back in February and March. This indicates there was/were a big player(s) that wanted out at these levels. Now the question remains, is/are those player(s) done selling here. If it does breakout, that'll be your signal that they're done for now and the stock should challenge its all time high of 82, at which time it would have completed the cup of a potential cup and handle pattern. At that point the stock should pause and form a handle that consolidate its gains, and wedges lower for a few weeks to shake out the remaining weak holders.

Of course CSCO moves with the market, and if the market fails to advance it will take CSCO down with it. If this happens I can see CSCO testing its low of 50, as it proceeds to form a double bottom pattern. So don't overstay your welcome on the long side if the market starts to look weak over several days.

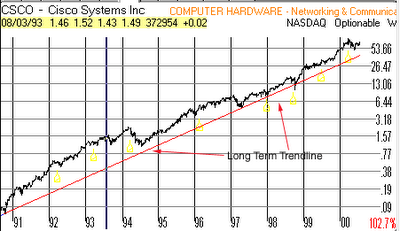

If you're a long-term investor looking to initiate a position, I would like the stock to head down and test its long term trend line, dating back to its IPO, at approximately $42/share. But remember, this line is sloping upward, so everyday that passes, the area I would like CSCO to test is rising. If the market were to tumble over the next few weeks, this line may move into the high 40's to low 50's strengthening the support for the stock in that area. Long term investors may want to watch this area as a place to initiate a position. A prolonged breakdown below this level, could signal that good days for CSCO are over.

In conclusion, I'm looking to go long right now at above 69 7/8, but, if the market turns I will look to short. In either case I have a plan, now it's time to execute.

Remember: 7% stop losses from your buy point on all trades, or whatever you're comfortable with. Preserve your capital, and you will live to fight another day. Lose it, and back to mutual funds you go.

No comments:

Post a Comment