If you were looking for a micro-cap stock that has the potential to run, then FCN is the company to do it.

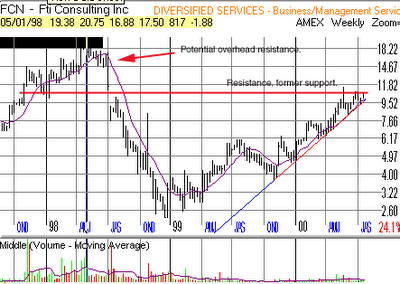

If you were looking for a micro-cap stock that has the potential to run, then FCN is the company to do it. The stock has been trending higher since November 1999 with pauses in between. The stock is currently in a 9 week cup and handle pattern. Volume has steadily dried up since the stock peaked on May 22nd, indicating that there aren't many sellers. During the course of the nine week consolidation there have been three price surges on above average volume, indicating heavy accumulation.

The stocks pivot point, breakout point, is 10 7/8. Look for a breakout on above average volume. If it can clear this pivot point, it should head higher to 14, where it may encounter resistance from some overhead supply left there after its early 1998 collapse. It will be healthy to see the stock pause at that level, and shakeout out the remaining weak holders, if any are left, and then attack and take out the old high at 19 3/8. Notice on the chart below, how the current resistance level coincides almost exactly with a former support level. It's always a good idea to look back at a long term chart to see if anything could be standing in your way.

But be careful with this one. The daily volume is thin, so the volatility could shake you out quite quickly. If it does, so be it, but don't let it piggy back you down with it if it turns down.

Remember: 7% stop losses from your buy point on all trades, or whatever you're comfortable with. Preserve your capital, and you will live to fight another day. Lose it, and back to mutual funds you go.

No comments:

Post a Comment