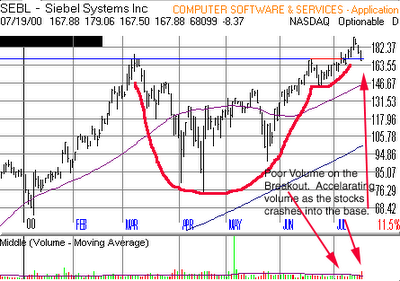

Here is a stock for those looking to enter an aggressive short position. Siebel Systems had formed a 14 week cup with a handle pattern, and broke out on 7/7 on average volume, which was the first sign that the stock was doomed to fail. Typically you'd like to see the stock break out on volume that is at least 50% higher then its 50 day moving average. The next two days it proceeded to pullback into the handle base on below average volume. On 7/12 the stock broke out again, but this time on below average volume. It continued higher for the next two days with no sign of volume pick up, which translated into a lack of conviction by the institutions to accumulate the stock. The second sign the stock was going to fail. Without the buying power of the institutions, stocks typically will not have enough power to move higher by themselves. On 7/17 the stock reversed course and started heading lower. The volume started to pick up as the stock headed lower, and today as the stock came back into the handle base, the stock fell 7 7/8 on volume that was 50% greater then the 50 day moving average. It looks like the stock wants to form a longer handle which will shakeout the rest of the weak holders, setting up for a future possible breakout.

The stock is a good short anywhere just under 170 1/2, which is the breakout point. The stock should head lower to approximately 147, which is it's 50 day moving average and bottom of the handle. If the stock breaks through this point on heavy volume, the bottom is anyone's guess, but I would say it would be around 120.

Keep your stop loss at 7% of your purchase price or right above the breakout point of 170 1/2 (for more conservative traders). This stock is volatile and may try to breakout again. If it does, be prepared to enter on the long side. If the volume is not above average look for the stock to pull back into the base, and become a short candidate once again. This stock tends to follow the market, so make sure you take that into consideration when deciding where to cover the short.

Remember: 7% stop losses from your buy point on all trades, or whatever you're comfortable with. Preserve your capital, and you will live to fight another day. Lose it, and back to mutual funds you go.

No comments:

Post a Comment