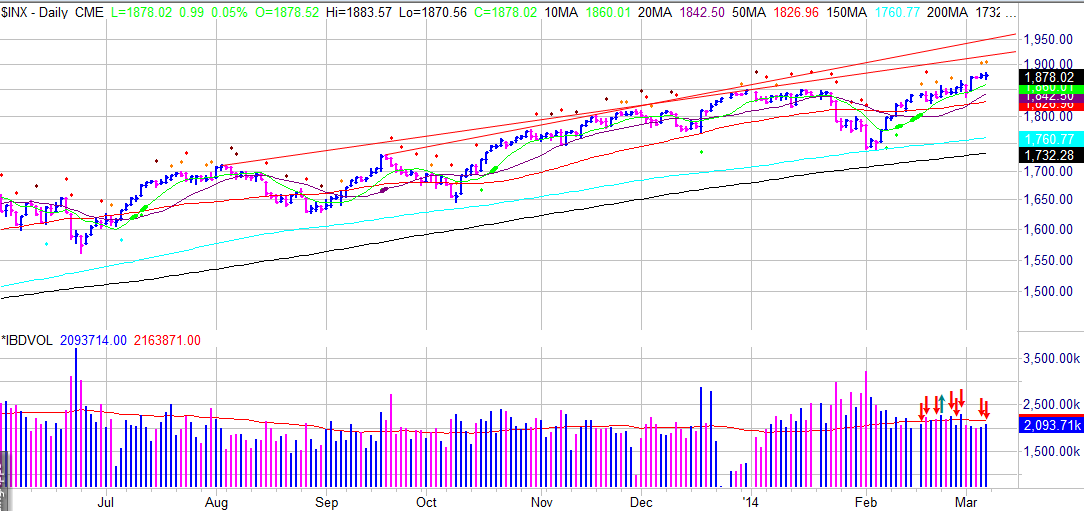

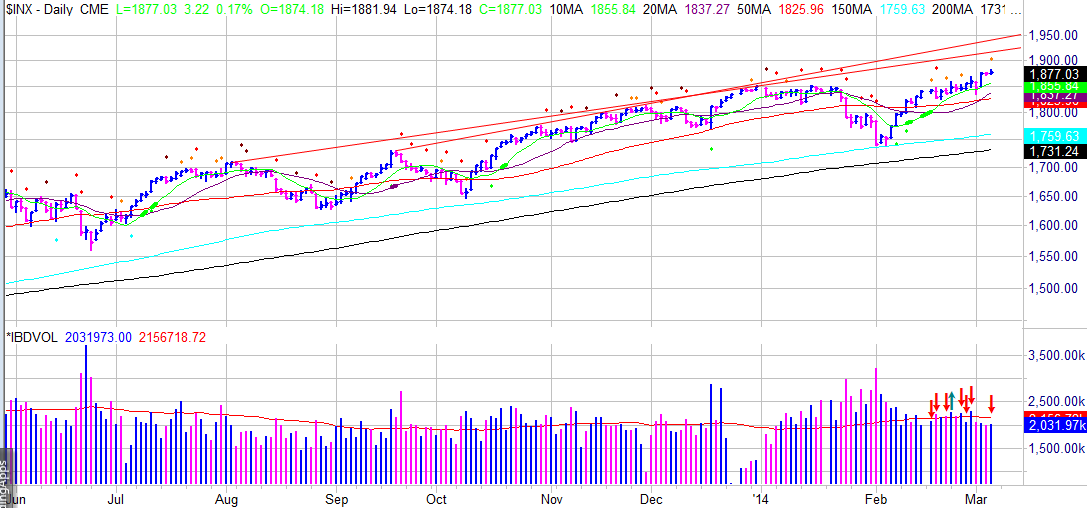

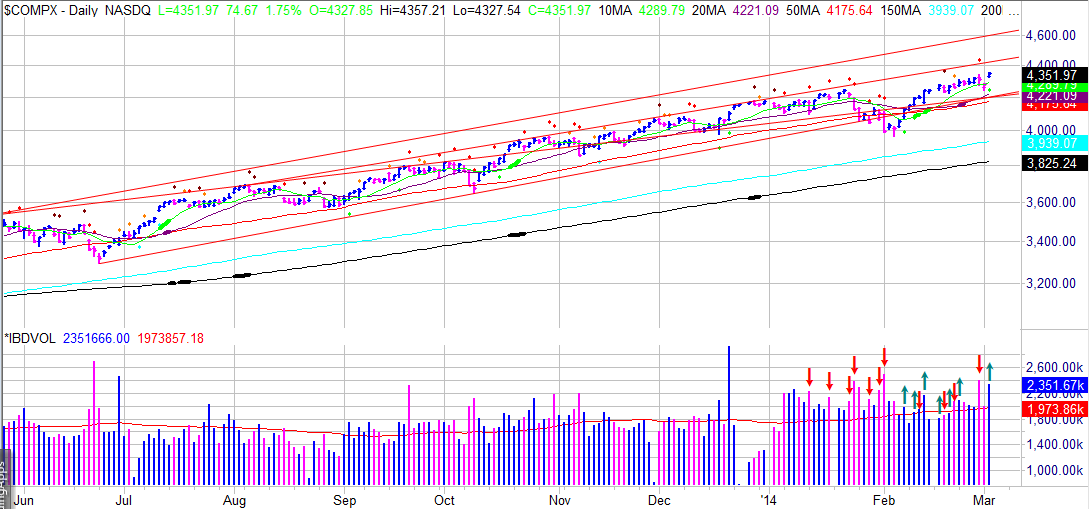

After shuffling sideways over the last two weeks, the market moved within striking distance of all time highs, surging around one percent in higher volume, closing near the highs of the day. Confirming the move was the the NYSE advance decline line leading into new highs and falling volatility. Throwing some cold water on the rally attempt, value is outperforming growth. While value can lead rallies, they tend to be choppier, shorter in length, and an indication of a nearing top, but can be profitable and cannot be ignored.

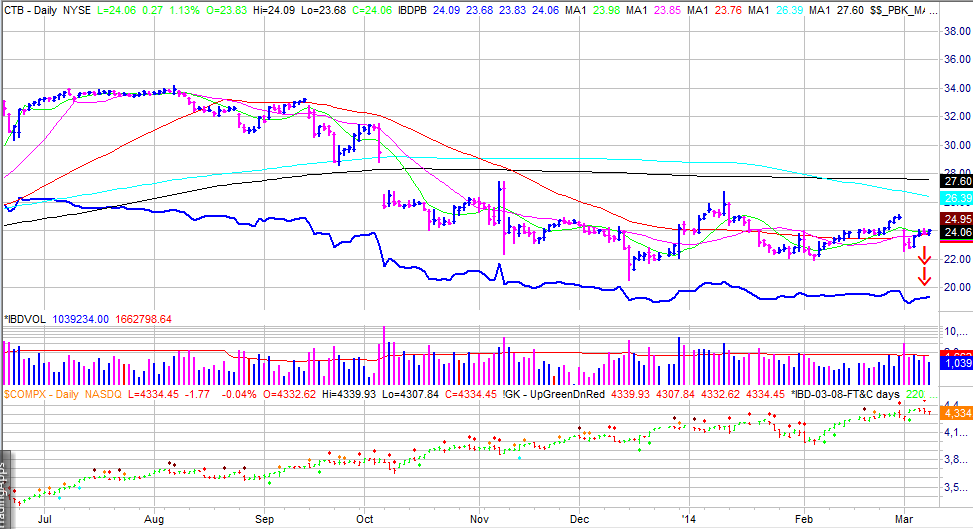

Leading growth stocks held up well during the recent distribution. While many broke below their fifty day moving averages, in above average volume, none did so in volume that signaled a run for the exits. Most of the action has been orderly, within expected correction levels, and recently tightening. Many still need another week or two to firm up, but some are starting to breakout and bounce off moving averages, in above average volume. US Silica Holdings (SLCA), Smith and Wesson Holdings (SWHC), and ARM Holdings (ARMH) broke out of cup and handle bases, and Hollysys Automation Tech (HOLI) and Chicago Bridge and Iron (CBI) broke out to new highs after bouncing off their fifty and twenty day moving averages, respectively. Now they need to hold and follow through.

Short idea setups turned out to be bear traps, leading to losses. Most breakdowns are failing, and the few managing to follow through, have not followed through enough to make up for the failing breakdowns. This type of action is generally indicative of a potential trend change or consolidation. A few are still setup and should be watched in case the correction resumes.

The combination of developing setups in leading growth stocks, markets inability to sell off in increased volume, and a leading NYSE advance/decline line, has increased the probability of successful short term rally attempt. Traders should be protecting profits and limiting losses on short positions, while initiating new long positions. If this rally attempt is real, recent breakouts must hold while new breakouts join the party, especially through shake outs over the next week or two, with each shakeout presenting a new group of trading opportunities.

The markets have changed trends quickly over the last 15 months, making the hardest things a trader has to do, be patient and flexible, at the same time, much harder.

TRADING IDEAS

Air Lease (AL) continues to consolidate along the twenty day moving average and recent three week tight pattern after a February breakout out of a flat base on top of a cup and handle base, in above average volume. A breakout above recent highs around thirty eight, could propel the stock for at least another ten to twenty percent. The relative strength line is already leading into new highs, a positive sign.

New Oriental Education and Tech (EDU) is still in the process of forming a double bottom base. Last weeks shakeout near the bottom, should have shaken out the remaining weak holders. A breakout above the recent consolidation around thirty dollars or mid point around thirty four dollars, should launch the stock into all time highs, and above an almost three year consolidation. The current double bottom base is the tightest, best positioned to breakout, and the relative strength line has manged to rise while the stock has consolidated the last two weeks.

Leading growth stocks held up well during the recent distribution. While many broke below their fifty day moving averages, in above average volume, none did so in volume that signaled a run for the exits. Most of the action has been orderly, within expected correction levels, and recently tightening. Many still need another week or two to firm up, but some are starting to breakout and bounce off moving averages, in above average volume. US Silica Holdings (SLCA), Smith and Wesson Holdings (SWHC), and ARM Holdings (ARMH) broke out of cup and handle bases, and Hollysys Automation Tech (HOLI) and Chicago Bridge and Iron (CBI) broke out to new highs after bouncing off their fifty and twenty day moving averages, respectively. Now they need to hold and follow through.

Short idea setups turned out to be bear traps, leading to losses. Most breakdowns are failing, and the few managing to follow through, have not followed through enough to make up for the failing breakdowns. This type of action is generally indicative of a potential trend change or consolidation. A few are still setup and should be watched in case the correction resumes.

The combination of developing setups in leading growth stocks, markets inability to sell off in increased volume, and a leading NYSE advance/decline line, has increased the probability of successful short term rally attempt. Traders should be protecting profits and limiting losses on short positions, while initiating new long positions. If this rally attempt is real, recent breakouts must hold while new breakouts join the party, especially through shake outs over the next week or two, with each shakeout presenting a new group of trading opportunities.

The markets have changed trends quickly over the last 15 months, making the hardest things a trader has to do, be patient and flexible, at the same time, much harder.

TRADING IDEAS

Air Lease (AL) continues to consolidate along the twenty day moving average and recent three week tight pattern after a February breakout out of a flat base on top of a cup and handle base, in above average volume. A breakout above recent highs around thirty eight, could propel the stock for at least another ten to twenty percent. The relative strength line is already leading into new highs, a positive sign.

New Oriental Education and Tech (EDU) is still in the process of forming a double bottom base. Last weeks shakeout near the bottom, should have shaken out the remaining weak holders. A breakout above the recent consolidation around thirty dollars or mid point around thirty four dollars, should launch the stock into all time highs, and above an almost three year consolidation. The current double bottom base is the tightest, best positioned to breakout, and the relative strength line has manged to rise while the stock has consolidated the last two weeks.