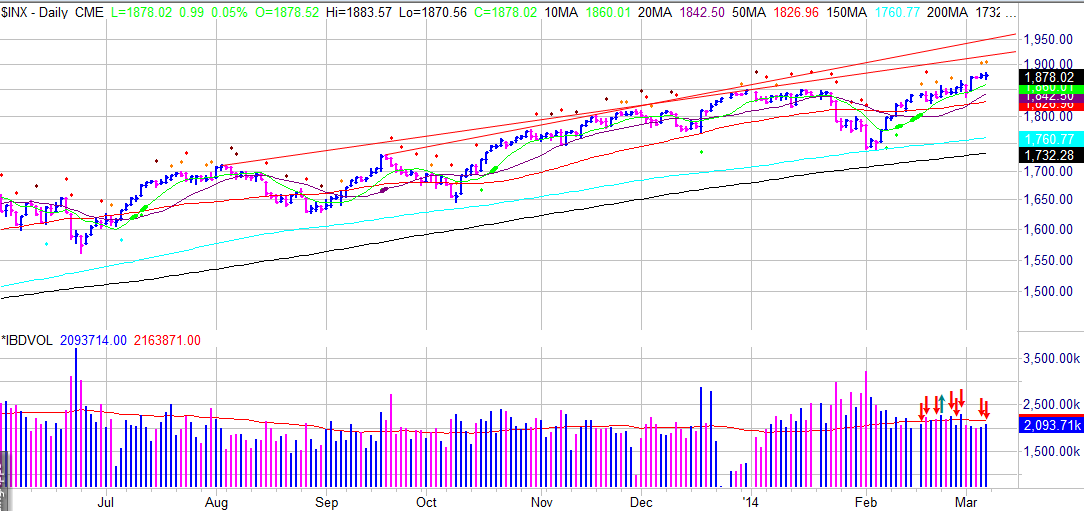

The market is getting worse by the day. For every good day we get, two bad seem to follow. More and more leading growth stocks are starting to lag and breakdown, and the market's distribution and stalling count is growing to worrisome levels. Long traders should be clearly out of over extended or newly acquired positions. Several stocks are still outperforming and resisting any selling pressure, and could still be held.

Short setups are slowly starting to work and follow through. Further upside with lack of follow through by leading growth stocks, should be shorted. The DOW seems intent on setting fifty two week and all time highs. Trader's should use this opportunity to add or initiate new short positions if conditions do not improve. Pullbacks have been short and shallow over the last year, so keep tight stops.

Otherwise, day trading or cash is the best position until the market sets up leading growth stocks again. That could take a few weeks.

Look for a weekend update of the Leading Growth Stocks Analysis and Short Setups.

Short setups are slowly starting to work and follow through. Further upside with lack of follow through by leading growth stocks, should be shorted. The DOW seems intent on setting fifty two week and all time highs. Trader's should use this opportunity to add or initiate new short positions if conditions do not improve. Pullbacks have been short and shallow over the last year, so keep tight stops.

Otherwise, day trading or cash is the best position until the market sets up leading growth stocks again. That could take a few weeks.

Look for a weekend update of the Leading Growth Stocks Analysis and Short Setups.

No comments:

Post a Comment