The Indices opened and promptly sold off, but managed to rally for the remainder of the day to close little changed. A few weeks ago, a morning sell off, followed by a rally into the close, would've produced big gains for traders. But today's action came in low, well below average volume, with no breakouts or additional follow through.

Leading growth stocks lagged from the open to the close, significantly under-performing the major averages. Solar and Internet stocks, Solar City (SCTY), Canadian Solar (CSIQ), YY (YY), Yelp (YELP), NQ Mobile (NQ), and SolarFun (SFUN) took the hardest hits in above average volume.

On several occasions over the last fourteen months, the market managed to move higher while leading growth stocks consolidated. In each case, traders would've been better off day trading or in cash, with a few core long and trading short positions, until the market finally pulled back and setup the next round of breakouts.

SHORT IDEAS - THE SETUP

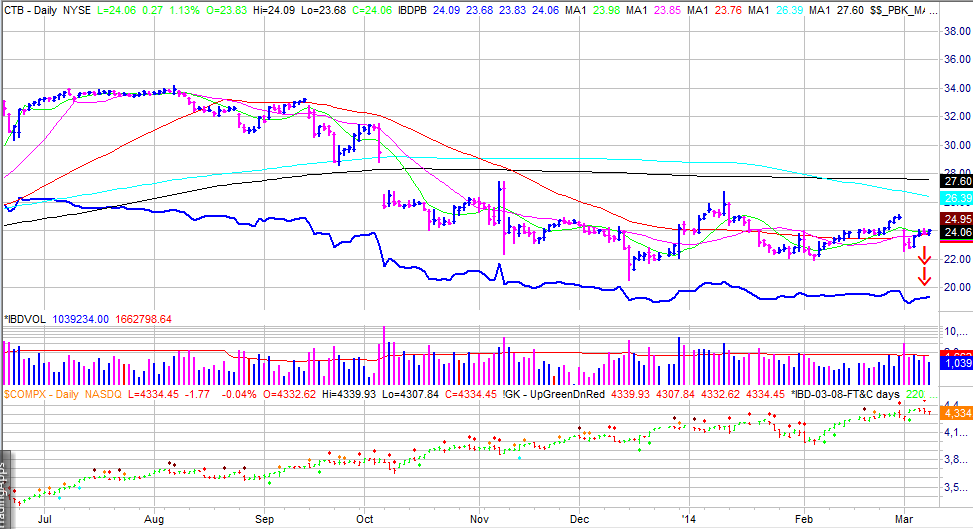

Cooper Tire and Rubber (CTB) is in the process of testing its 50 day moving average and head and shoulder neckline on low volume. The stock has under-performed the general market since the middle of 2013 and looks poised to move lower on a breakdown below the 50 day moving average.

Conn's Inc (CONN) was a big market winner from the end of 2011 into 2013, rising over 1,000%. The stock topped toward the end of 2013 and has lagged even since. On February 20th, the stock gapped down on poor revenue and earning's guidance in heavy volume. The recent consolidation into the 10 day moving average in low volume is an indication of lower prices ahead. A break down below the recent consolidation could see the stock sell off an additional 10 - 20% over the near term.

Leading growth stocks lagged from the open to the close, significantly under-performing the major averages. Solar and Internet stocks, Solar City (SCTY), Canadian Solar (CSIQ), YY (YY), Yelp (YELP), NQ Mobile (NQ), and SolarFun (SFUN) took the hardest hits in above average volume.

On several occasions over the last fourteen months, the market managed to move higher while leading growth stocks consolidated. In each case, traders would've been better off day trading or in cash, with a few core long and trading short positions, until the market finally pulled back and setup the next round of breakouts.

SHORT IDEAS - THE SETUP

Cooper Tire and Rubber (CTB) is in the process of testing its 50 day moving average and head and shoulder neckline on low volume. The stock has under-performed the general market since the middle of 2013 and looks poised to move lower on a breakdown below the 50 day moving average.

Conn's Inc (CONN) was a big market winner from the end of 2011 into 2013, rising over 1,000%. The stock topped toward the end of 2013 and has lagged even since. On February 20th, the stock gapped down on poor revenue and earning's guidance in heavy volume. The recent consolidation into the 10 day moving average in low volume is an indication of lower prices ahead. A break down below the recent consolidation could see the stock sell off an additional 10 - 20% over the near term.

No comments:

Post a Comment