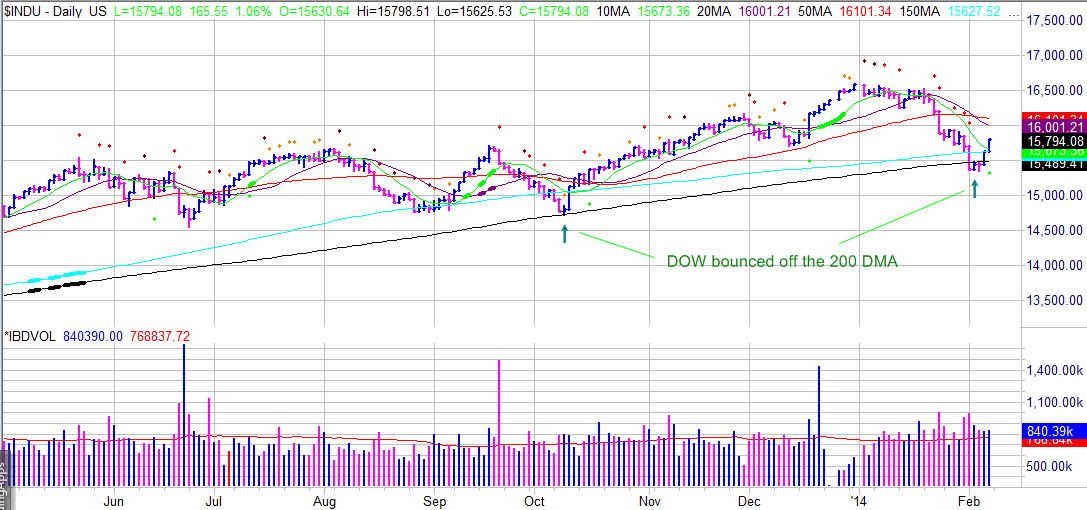

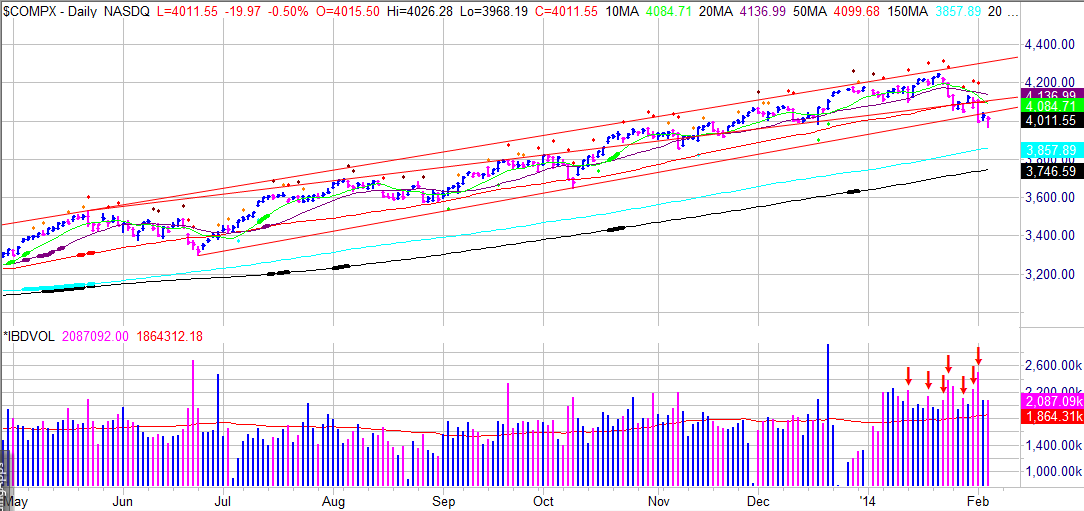

The market opened up, shook around for about thirty minutes, and rallied strongly into the close. Weak, below average volume cast doubt on the strength. After four recent distribution days, it would have been nice to see the market rise on higher volume. The recent pattern of buying on lower volume followed by heavier volume selling or stalling continues is becoming worrisome.

Leading growth stocks in general are acting perfectly. We've had few breakdowns or major stalling action, and breakouts are on strong volume with meaningful follow through. But, several of the early movers are in potential climax runs, new long setups fail to follow through and shakeout traders, and intra-day movement is becoming more volatile.

Taser International (TASR) followed on gains to its recent breakout, a day after shaking out investors on a strong earning's report. NQ Mobile (NQ) is adding to gain out of a quirky cup and handle, Hovnanian (HOV) is moving up the right side of its cup base, and Chipotle Mexican Grille (CMG) readying to break out of its four week tight range.

On the downside, Questcor Pharmeceuticals (QCOR) sold off another 9% a day after a somewhat disappointing earning's report and falling below its double bottom pivot point, Valeant Pharmaceuticals (VRX) gave up all its gains after a strong earning's report, and Continental Resources (CLR) is threatening to fail from its cup breakout after a weak earning's report.

A top is a slow process regardless of rally strength. The market sends just short of enough clues when it is topping, but it is only clear after it starts to collapse and traders become deer in headlights. The clues are meant to reduce market exposure, tighten stops and protect profits on over extended climactic stocks and control losses on new positions, while remaining patient with strong positions until a major sell signal appears. The clues tend to be early at times, that is why staying patient with a handful of positions that are acting exactly as they should, maintains market exposure while reducing overall exposure just in case.

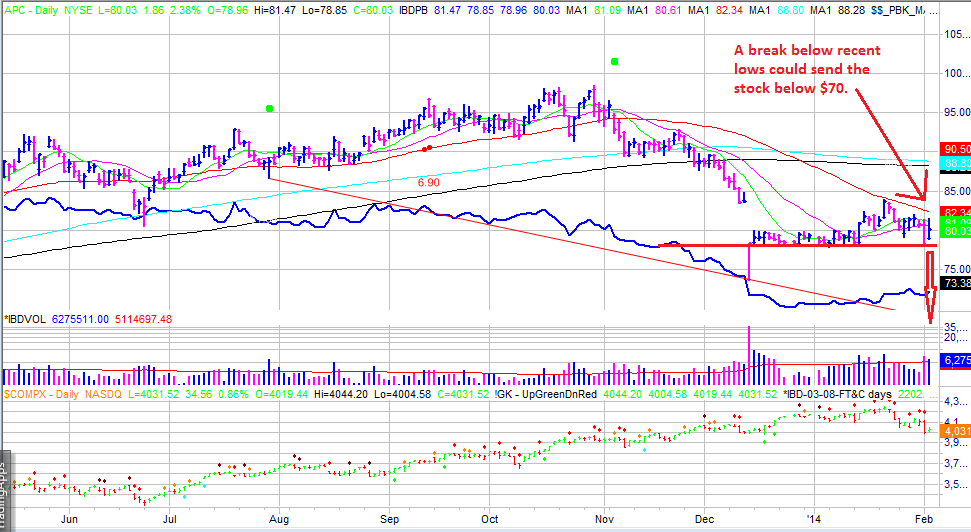

SHORT IDEAS - THE SETUPS

DF has lagged the market since August of 2013. The stock fails to rally with the market and sells off fast and hard when the market pulls back. A break off the 20 day moving average on heavy volume could carry the stock below $13.

Leading growth stocks in general are acting perfectly. We've had few breakdowns or major stalling action, and breakouts are on strong volume with meaningful follow through. But, several of the early movers are in potential climax runs, new long setups fail to follow through and shakeout traders, and intra-day movement is becoming more volatile.

Taser International (TASR) followed on gains to its recent breakout, a day after shaking out investors on a strong earning's report. NQ Mobile (NQ) is adding to gain out of a quirky cup and handle, Hovnanian (HOV) is moving up the right side of its cup base, and Chipotle Mexican Grille (CMG) readying to break out of its four week tight range.

On the downside, Questcor Pharmeceuticals (QCOR) sold off another 9% a day after a somewhat disappointing earning's report and falling below its double bottom pivot point, Valeant Pharmaceuticals (VRX) gave up all its gains after a strong earning's report, and Continental Resources (CLR) is threatening to fail from its cup breakout after a weak earning's report.

A top is a slow process regardless of rally strength. The market sends just short of enough clues when it is topping, but it is only clear after it starts to collapse and traders become deer in headlights. The clues are meant to reduce market exposure, tighten stops and protect profits on over extended climactic stocks and control losses on new positions, while remaining patient with strong positions until a major sell signal appears. The clues tend to be early at times, that is why staying patient with a handful of positions that are acting exactly as they should, maintains market exposure while reducing overall exposure just in case.

SHORT IDEAS - THE SETUPS

DF has lagged the market since August of 2013. The stock fails to rally with the market and sells off fast and hard when the market pulls back. A break off the 20 day moving average on heavy volume could carry the stock below $13.