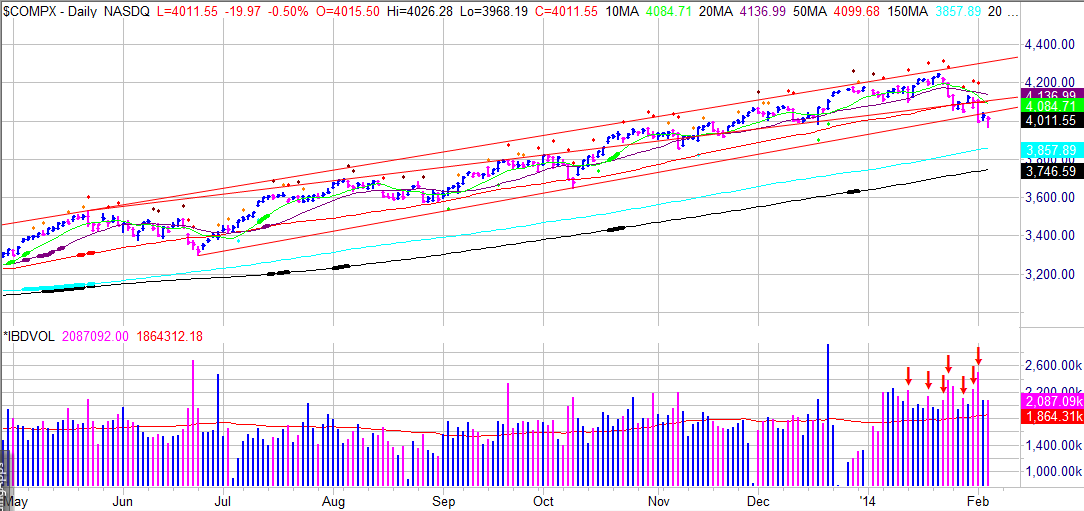

It was an uneventful market day. Indexes closed modestly down on unchanged volume, leading growth stocks under performed on higher volume, and short ideas consolidated recent heavy selling. Expect volatility to pick up again as the Government's Friday Monthly Unemployment Report approaches. The question on everyone's mind, regardless of the number, how does this affect the taper?

Reactions to earning's reports after hours were mixed for growth stocks. Twitter (TWTR) and Pandora (P) gapped down while YELP (YELP) and Green Mountain Coffee Roasters (GMCR) were gapping up. GMCR earning's report wasn't anything to write home about, but a strategic partnership with Coca-Cola (K), to buy a ten percent steak in the company, excited Wall Street. SodaStream International (SODA) shareholders were not as thrilled, as this is seen as a direct future threat to their business. The stock sold off on the new in after hours trading.

Review the short picks from yesterday's blog, Market Higher But Volume Lags Leading Growth Stocks Consolidating, Rackspace (RAX), Newfield Exploration (NFX), Anadarko Petroleum (APC), and Select Comfort (SCSS) which reported a missed earning's report after the close.

Netflix (NFLX) broke out on a heavy volume gap up after reporting surprisingly strong earnings on January 23rd. The stock has since managed to rise further in the face of a weak market. It is now quietly pulling back to the ten day moving average providing a secondary entry. A breakout above the recent high of 412.40 could carry the stock to $500.

Valeant Pharmaceutical (VRX) recently broke out of a flat base on heavy volume and has been digesting those gains into the twenty day moving average on lighter volume. Earnings are expected around February 27th. If the stock can break above 140.36, momentum could carry the stock into the $150 - 160 range.

Perrigo (PRGO) has been forming a flat base on top of a flat base for the last nine weeks after breaking out of a cup and handle base in October. The stock is scheduled to report earnings tomorrow morning before the opening bell. A breakout above 162.35 on heavy volume could send the stock up into the $190 range over the next few weeks.

With rising volatility, large quick moves in either direction could be profitable for shorter tem traders. Continue to exercise caution and patience with new positions. Intra-day volatility turns newly entered positions from profit to loss to profit to loss in minutes. Place stops where the stock should not go to and ignore the bouncing stock. As annoying as it has become, keep long and short lists updated. During volatile times, these lists change much more frequently and require more work to track. .

Reactions to earning's reports after hours were mixed for growth stocks. Twitter (TWTR) and Pandora (P) gapped down while YELP (YELP) and Green Mountain Coffee Roasters (GMCR) were gapping up. GMCR earning's report wasn't anything to write home about, but a strategic partnership with Coca-Cola (K), to buy a ten percent steak in the company, excited Wall Street. SodaStream International (SODA) shareholders were not as thrilled, as this is seen as a direct future threat to their business. The stock sold off on the new in after hours trading.

Review the short picks from yesterday's blog, Market Higher But Volume Lags Leading Growth Stocks Consolidating, Rackspace (RAX), Newfield Exploration (NFX), Anadarko Petroleum (APC), and Select Comfort (SCSS) which reported a missed earning's report after the close.

Netflix (NFLX) broke out on a heavy volume gap up after reporting surprisingly strong earnings on January 23rd. The stock has since managed to rise further in the face of a weak market. It is now quietly pulling back to the ten day moving average providing a secondary entry. A breakout above the recent high of 412.40 could carry the stock to $500.

Valeant Pharmaceutical (VRX) recently broke out of a flat base on heavy volume and has been digesting those gains into the twenty day moving average on lighter volume. Earnings are expected around February 27th. If the stock can break above 140.36, momentum could carry the stock into the $150 - 160 range.

Perrigo (PRGO) has been forming a flat base on top of a flat base for the last nine weeks after breaking out of a cup and handle base in October. The stock is scheduled to report earnings tomorrow morning before the opening bell. A breakout above 162.35 on heavy volume could send the stock up into the $190 range over the next few weeks.

With rising volatility, large quick moves in either direction could be profitable for shorter tem traders. Continue to exercise caution and patience with new positions. Intra-day volatility turns newly entered positions from profit to loss to profit to loss in minutes. Place stops where the stock should not go to and ignore the bouncing stock. As annoying as it has become, keep long and short lists updated. During volatile times, these lists change much more frequently and require more work to track. .

No comments:

Post a Comment