After Monday's heavy sell off on huge volume, the market felt like it was on the verge of a much deeper correction. But, by the end of the week, market conditions improved dramatically. The indexes recovered all of the early week's losses to close virtually unchanged for the third straight week. The indexes bounced from over sold conditions, the NASDAQ bounced off a lower supporting trend line stretching back to July 2013, and its 1.69% gain on higher, above average volume, would've been considered a follow through day had it had occurred one day later.

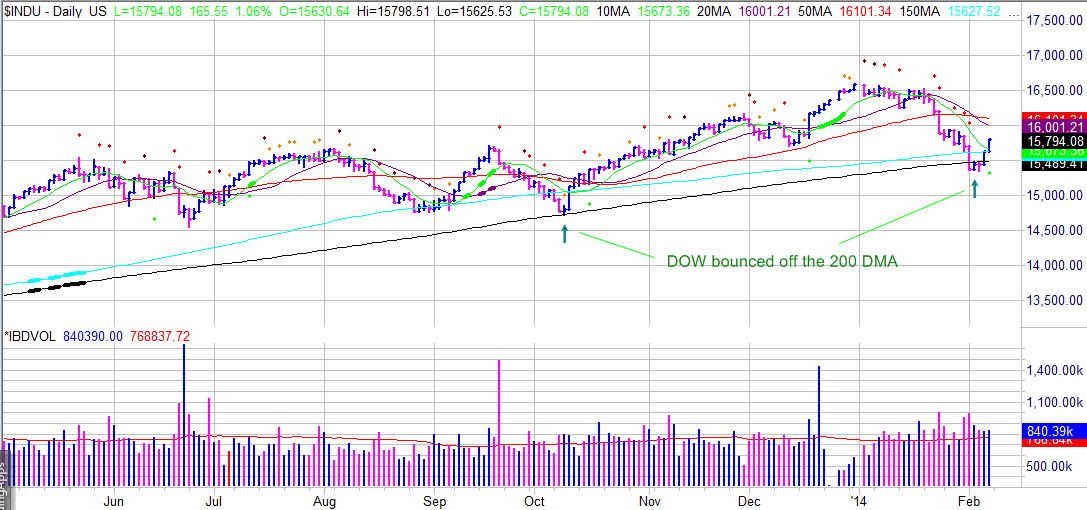

The DOW bounced off its two hundred day moving average. In October, the DOW with the longest and deepest pullback at that time, similar to now, bounced off the two hundred day moving average and continued to rally for the next 3 months. Producing big gains in leading growth stocks.

While the bounce was expected and could be nothing more then a dead cat bounce from an over sold condition, leading growth stocks continued consolidating and breaking out to new highs on higher, above average volume. Very bullish behavior.

Facebook (FB), Netflix (NFLX), Michael Kors Holdings (KORS), YELP (YELP), NVR (NVR), Under Armor (UA), Chipotle Mexican Grill (CMG), Diamondback Energy (FANG), Alexion Pharmaceuticals (ALXN), Horizon Pharma (HZNP), and Qihoo 360 Technology (QIHU) added to or held onto gains from recent, above average, high volume breakouts.

A new group of leading growth stocks are setting up quite nicely. Home builder Hovnanian (HOV) has been forming a year long cup and handle. The handle is a quiet pullback to the fifty day moving average on lower volume. A strong high volume breakout above both trend lines, at $6.00 and/or $6.80, would mark the beginning of a new multi-month rise in the stock price. The stock had already more then doubled from its cup and handle breakout in 2012 before forming the current consolidation. Fundamentals and expectations are excellent for the stock and its entire group. The group has moved from one of the worst, to one of the best within the last three months. The relative strength line is a potential negative. It only recently started to trend higher but has held flat during the recent selling, a positive sign. Earnings are expected March 5th.

Questcor Pharmaceuticals (QCOR) has more then tripled since falling off a cliff, dropping over sixty five percent in September 2012, after a Citron Research report and an Aetna payment denial report. The stock has made a strong, above average, high volume move over the last five weeks, digesting those gains on lower volume last week to form a double bottom with a handle. A breakout above the handle high of 67.11 or double bottom mid-point 70.17 would mark the beginning of a new multi-month rise in stock price. The stock is part of the very strong medical sector and has has one of the strongest records of sales and earnings growth. Estimates are expecting strong growth over the next three years. A PE expansion price target on the stock would almost triple the stock price. Earnings are expected February 25th.

The question on everyone's mind, what's next for the market? But that is not the question to worry about. It's more important to know how leading growth stocks should behave regardless of market action. That's the biggest clue to what will happen next.

If the market continues rise, recent breakouts should continue to make progress and new breakouts should occur after every pullback or shakeout. Continuing the markets year long pattern of short pullbacks that turn on a dime and keep rallying.

If the market sells off to new lows or shuffles sideways, recent breakouts should be able to hold gains, and digest them as their ten and twenty day moving averages catch up. Leading growth stocks consolidating should stay within their consolidations and continue to tighten with every attempted rally. There will be ugly down days for even the strongest stocks, but look at them in the context of their previous movement, not that days sharp selling.

At this point of the bull market, the market has revealed ninety nine percent of the stocks that have the fundamentals and technicals to lead the market. There is no need to go on the hunt for the needle in the haystack stock, there are plenty of well know leading growth stocks, that is a more of an exercise after a bear market. Institutions and the public are now interested in hopping on the momentum wagon, in stocks with proven histories and strong estimates, not dogs with good stories but no follow through up to this point.

Regardless of direction, investors should be on the lookout for entry points. It is rare that a stock will defy direction, especially to the downside, but there are always stocks that do and are the first one's to breakout. Make sure the stock has at least ninety to ninety five percent or more of the fundamental and technical conditions required. Sales and earning's growth history and estimates should be strong and rising, the relative strength line should be trending higher and at or approaching new highs, and has already proven to be a leader during the five year bull market.

The DOW bounced off its two hundred day moving average. In October, the DOW with the longest and deepest pullback at that time, similar to now, bounced off the two hundred day moving average and continued to rally for the next 3 months. Producing big gains in leading growth stocks.

While the bounce was expected and could be nothing more then a dead cat bounce from an over sold condition, leading growth stocks continued consolidating and breaking out to new highs on higher, above average volume. Very bullish behavior.

Facebook (FB), Netflix (NFLX), Michael Kors Holdings (KORS), YELP (YELP), NVR (NVR), Under Armor (UA), Chipotle Mexican Grill (CMG), Diamondback Energy (FANG), Alexion Pharmaceuticals (ALXN), Horizon Pharma (HZNP), and Qihoo 360 Technology (QIHU) added to or held onto gains from recent, above average, high volume breakouts.

A new group of leading growth stocks are setting up quite nicely. Home builder Hovnanian (HOV) has been forming a year long cup and handle. The handle is a quiet pullback to the fifty day moving average on lower volume. A strong high volume breakout above both trend lines, at $6.00 and/or $6.80, would mark the beginning of a new multi-month rise in the stock price. The stock had already more then doubled from its cup and handle breakout in 2012 before forming the current consolidation. Fundamentals and expectations are excellent for the stock and its entire group. The group has moved from one of the worst, to one of the best within the last three months. The relative strength line is a potential negative. It only recently started to trend higher but has held flat during the recent selling, a positive sign. Earnings are expected March 5th.

Questcor Pharmaceuticals (QCOR) has more then tripled since falling off a cliff, dropping over sixty five percent in September 2012, after a Citron Research report and an Aetna payment denial report. The stock has made a strong, above average, high volume move over the last five weeks, digesting those gains on lower volume last week to form a double bottom with a handle. A breakout above the handle high of 67.11 or double bottom mid-point 70.17 would mark the beginning of a new multi-month rise in stock price. The stock is part of the very strong medical sector and has has one of the strongest records of sales and earnings growth. Estimates are expecting strong growth over the next three years. A PE expansion price target on the stock would almost triple the stock price. Earnings are expected February 25th.

The question on everyone's mind, what's next for the market? But that is not the question to worry about. It's more important to know how leading growth stocks should behave regardless of market action. That's the biggest clue to what will happen next.

If the market continues rise, recent breakouts should continue to make progress and new breakouts should occur after every pullback or shakeout. Continuing the markets year long pattern of short pullbacks that turn on a dime and keep rallying.

If the market sells off to new lows or shuffles sideways, recent breakouts should be able to hold gains, and digest them as their ten and twenty day moving averages catch up. Leading growth stocks consolidating should stay within their consolidations and continue to tighten with every attempted rally. There will be ugly down days for even the strongest stocks, but look at them in the context of their previous movement, not that days sharp selling.

At this point of the bull market, the market has revealed ninety nine percent of the stocks that have the fundamentals and technicals to lead the market. There is no need to go on the hunt for the needle in the haystack stock, there are plenty of well know leading growth stocks, that is a more of an exercise after a bear market. Institutions and the public are now interested in hopping on the momentum wagon, in stocks with proven histories and strong estimates, not dogs with good stories but no follow through up to this point.

Regardless of direction, investors should be on the lookout for entry points. It is rare that a stock will defy direction, especially to the downside, but there are always stocks that do and are the first one's to breakout. Make sure the stock has at least ninety to ninety five percent or more of the fundamental and technical conditions required. Sales and earning's growth history and estimates should be strong and rising, the relative strength line should be trending higher and at or approaching new highs, and has already proven to be a leader during the five year bull market.

No comments:

Post a Comment