MARKET UPDATE

Asian markets sold off over one percent, Europe was trading down, the US markets were indicated significantly lower and opened down. But as quickly as the market opened down, within fifteen minutes, the market turned and headed higher, barely pausing for the remainder of the day and closing at the highs, adding a third strong accumulation day in the last week. The NASDAQ is now within .15% of a fifty two week high.

The market is in a good news is good news and bad new is good news mood. Retail sales and weekly jobless claims disappointed with an initial negative reaction, but that was recovered quickly. It seems the market could be baking in a pause in the taper and increase in the bond buying as a best case scenario because recent economic indicators have been pointing to a slow down in the economy. While this is wishful thinking, it is enough to fuel the rally until Fed governors indicate otherwise between the next meeting or taper again at the next meeting in March.

Traders should be long at least a few positions and looking to add or initiate new positions on weak openings or pullbacks. If last year's pattern holds, weak openings may be the only additional opportunities to get in on low risk entries. But, the further we rally, the risk of new setups failing begins to increase exponentially as they would be viewed as laggards and first to be sold by traders.

LEADING STOCK ANALYSIS

Leading growth stocks were barely phased by the weak opening. Many opened lower along with the market, but most found their footing immediately and continued to break out and follow through on recent breakouts, further confirming the bullish overall action since the market bottomed February 5th.

Chipotle Mexican Grill (CMG) broke out of a double bottom with high handle base, Questcor (QCOR) cleared the mid point of a double bottom base, Vipshop Holdings (VIPS), ARRIS Group (ARRS), Synaptics (SYNA), and Northstar Realty Finance (NRF) broke out from pullbacks to the twenty day moving average. Tesla Motors (TSLA), Facebook (FB), Netflix (NFLX), Michael Kors (KORS), and Ligand Pharmaceuticals (LGND) continued to follow through on recent strong action after breaking out over the last few weeks. All on above average trade.

THE SETUPS

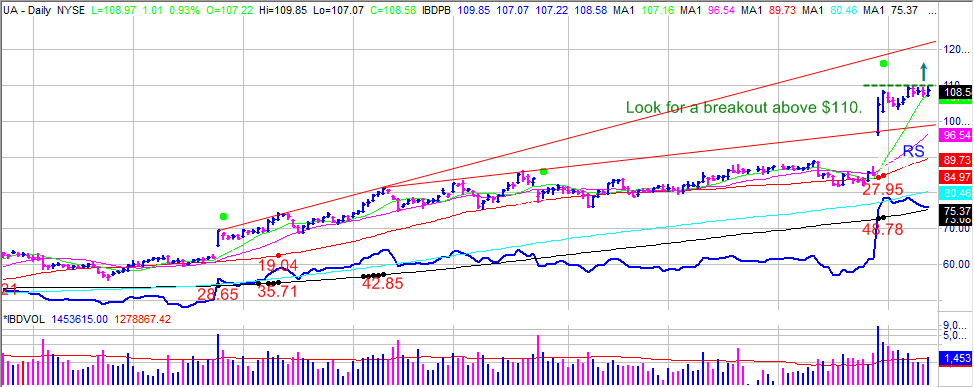

Under Armor (UA) has been one of the bull market's biggest winners, rising over 1,000%. The stock could be in the final stages of its run and in the midst of a climax run. A break above $110 could carry the stock another 10 - 20% as it completes the climax top.

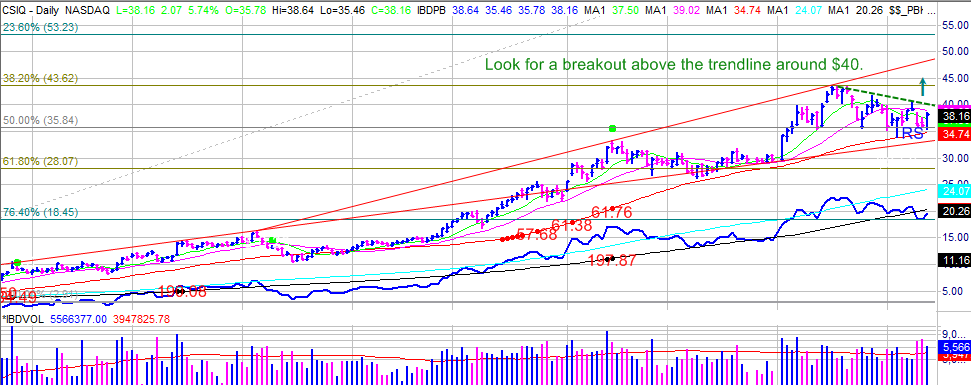

Canadian Solar (CSIQ) is part of the hot solar group. The stock has run up over 1,000% in the past year and is in the midst of setting up a late stage, flat base pullback to the fifty day moving average. The stock sports the best fundamentals among its peers. A break above the downtrend line around $40 could spark another 20 - 30% rise in the stock price.

Asian markets sold off over one percent, Europe was trading down, the US markets were indicated significantly lower and opened down. But as quickly as the market opened down, within fifteen minutes, the market turned and headed higher, barely pausing for the remainder of the day and closing at the highs, adding a third strong accumulation day in the last week. The NASDAQ is now within .15% of a fifty two week high.

The market is in a good news is good news and bad new is good news mood. Retail sales and weekly jobless claims disappointed with an initial negative reaction, but that was recovered quickly. It seems the market could be baking in a pause in the taper and increase in the bond buying as a best case scenario because recent economic indicators have been pointing to a slow down in the economy. While this is wishful thinking, it is enough to fuel the rally until Fed governors indicate otherwise between the next meeting or taper again at the next meeting in March.

Traders should be long at least a few positions and looking to add or initiate new positions on weak openings or pullbacks. If last year's pattern holds, weak openings may be the only additional opportunities to get in on low risk entries. But, the further we rally, the risk of new setups failing begins to increase exponentially as they would be viewed as laggards and first to be sold by traders.

LEADING STOCK ANALYSIS

Leading growth stocks were barely phased by the weak opening. Many opened lower along with the market, but most found their footing immediately and continued to break out and follow through on recent breakouts, further confirming the bullish overall action since the market bottomed February 5th.

Chipotle Mexican Grill (CMG) broke out of a double bottom with high handle base, Questcor (QCOR) cleared the mid point of a double bottom base, Vipshop Holdings (VIPS), ARRIS Group (ARRS), Synaptics (SYNA), and Northstar Realty Finance (NRF) broke out from pullbacks to the twenty day moving average. Tesla Motors (TSLA), Facebook (FB), Netflix (NFLX), Michael Kors (KORS), and Ligand Pharmaceuticals (LGND) continued to follow through on recent strong action after breaking out over the last few weeks. All on above average trade.

THE SETUPS

Under Armor (UA) has been one of the bull market's biggest winners, rising over 1,000%. The stock could be in the final stages of its run and in the midst of a climax run. A break above $110 could carry the stock another 10 - 20% as it completes the climax top.

Canadian Solar (CSIQ) is part of the hot solar group. The stock has run up over 1,000% in the past year and is in the midst of setting up a late stage, flat base pullback to the fifty day moving average. The stock sports the best fundamentals among its peers. A break above the downtrend line around $40 could spark another 20 - 30% rise in the stock price.

No comments:

Post a Comment