The market opened higher but quickly turned lower, only to find its footing and rally higher for the rest of the day. Volume lagged again, throwing suspicion to the quality of the attempt. Every recent rally attempt on lagging volume has been followed by high volume selling the following day.

While the market attempted to rally, Short Ideas stocks continued lower and tightened up for further downside.

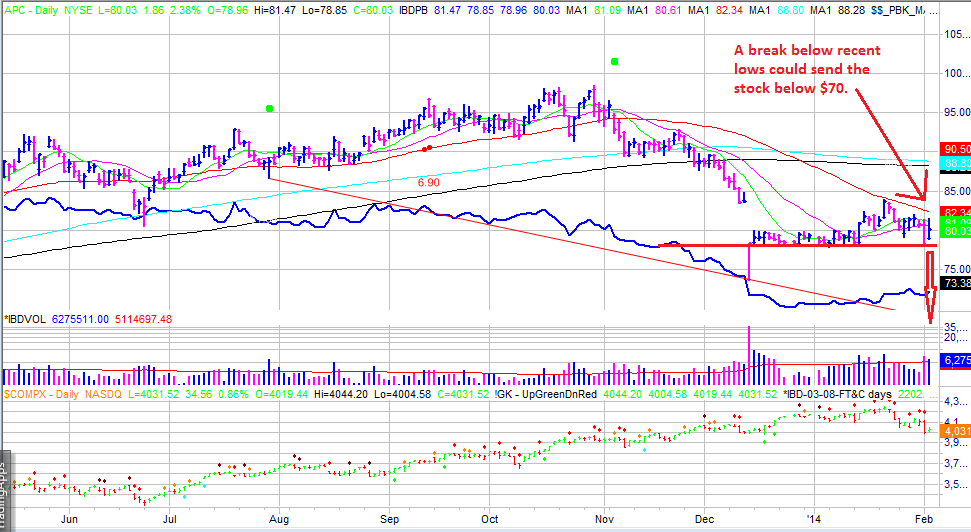

Anadarko Petroleum (APC) barely budged after reporting earnings this morning, rallying on lighter volume towards the ten and twenty day moving averages after rolling off the fifty day moving average two weeks ago. A break down below the recent low of 78.15 could send the stock into the low $70's or below.

Rackspace Holdings (RAX) is also consolidating into its fifty day moving average ahead of its earning's report on February 10th. A poor earning's report could send the stock gapping down to the low $30's. The stock has been forming a head and shoulder pattern since 2012.

Newfield Exploration (NFX) has been rolling off its fifty day moving average for the last two weeks and looks ready to test its head and shoulder pattern neckline around $22.50. Short the stock below the recent low of 24.96.

Select Comfort (SCSS) gapped down on earnings January 6th and has slowly digested those losses around the ten day moving average and is slowly rolling over for another big move lower towards the trend line around $14. Look for a break below 16.10.

J.C. Penney (JCP) continued its meltdown to all time lows. The stock gapped up at the open on positive same store sales, but quickly turned significantly lower on heavy volume and closed at the lows of the day and all time lows. Day traders can take advantage of the stocks habit of trending during the day.

Leading Growth Stocks recovered some of the losses from the previous session, but many need more time to finish proper consolidations while others are preparing to breakout or have broken out.

Michael Kors (KORS) broke out of a flat base pullback to the fifty day moving average on heavy volume after reporting a strong earning's report before the open. The stock should be watched for a new entry point over the next few days as the stock drifts down to sideways on lower volume.

Methode Electronics (MEI) has more then tripled since its first breakout, at the beginning of 2013, out of a cup and handle base, is now forming a flat base pullback to the fifty day moving average ahead of its earning's report February 27th. A move above the trend line around $35 could set the stock for a breakout move to $45.

The market continues to indicate more downside. But, as has been the pattern all year, leading growth stocks are starting to setup new consolidations to break out of over the next few weeks. New short trades should not be held for more then a few days, if not shorter. The market is still over extended to the downside and can become even more over extended, setting up a potential snap back rally over the next week or two.

While the market attempted to rally, Short Ideas stocks continued lower and tightened up for further downside.

Anadarko Petroleum (APC) barely budged after reporting earnings this morning, rallying on lighter volume towards the ten and twenty day moving averages after rolling off the fifty day moving average two weeks ago. A break down below the recent low of 78.15 could send the stock into the low $70's or below.

Rackspace Holdings (RAX) is also consolidating into its fifty day moving average ahead of its earning's report on February 10th. A poor earning's report could send the stock gapping down to the low $30's. The stock has been forming a head and shoulder pattern since 2012.

Newfield Exploration (NFX) has been rolling off its fifty day moving average for the last two weeks and looks ready to test its head and shoulder pattern neckline around $22.50. Short the stock below the recent low of 24.96.

Select Comfort (SCSS) gapped down on earnings January 6th and has slowly digested those losses around the ten day moving average and is slowly rolling over for another big move lower towards the trend line around $14. Look for a break below 16.10.

J.C. Penney (JCP) continued its meltdown to all time lows. The stock gapped up at the open on positive same store sales, but quickly turned significantly lower on heavy volume and closed at the lows of the day and all time lows. Day traders can take advantage of the stocks habit of trending during the day.

Leading Growth Stocks recovered some of the losses from the previous session, but many need more time to finish proper consolidations while others are preparing to breakout or have broken out.

Michael Kors (KORS) broke out of a flat base pullback to the fifty day moving average on heavy volume after reporting a strong earning's report before the open. The stock should be watched for a new entry point over the next few days as the stock drifts down to sideways on lower volume.

Methode Electronics (MEI) has more then tripled since its first breakout, at the beginning of 2013, out of a cup and handle base, is now forming a flat base pullback to the fifty day moving average ahead of its earning's report February 27th. A move above the trend line around $35 could set the stock for a breakout move to $45.

The market continues to indicate more downside. But, as has been the pattern all year, leading growth stocks are starting to setup new consolidations to break out of over the next few weeks. New short trades should not be held for more then a few days, if not shorter. The market is still over extended to the downside and can become even more over extended, setting up a potential snap back rally over the next week or two.

No comments:

Post a Comment