Wednesday, April 30, 2014

US Stock Market Update and Trading Ideas: Lannett (LCI) Jazz Pharmaceutical (JAZZ)

After being on the verge of falling apart Monday afternoon, the market registered a second strong up day and is on the now on the verge of confirming the rally attempt started April 15th after a heavy, above average volume reversal off the two hundred day moving average. The Dow, New York Stock Exchange, and SP 500 are withing one percent of all time highs, and the NYSE advance/decline line has been leading into new highs.

Leading growth stocks finally outperformed and started to round up cup shaped bases and add to recent gains. Zillow (Z) which failed its cup and handle base breakout just two day ago, broke back above the original pivot point in higher, well above average volume. Smith and Wesson (SWHC) broke out of a cup and handle base, and Western Refining (WNR) followed through on its cup and handle breakout Monday. Skechers (SKX) and Apple (AAPL) added to their break away gaps on earning's reports.

Reviewing the trading action over the last two weeks, there have been some scary days and a lot of shakeouts, but little distribution. Price volume favors a continuation of this rally. The only missing piece is more follow through by leading growth stocks bouncing off moving averages. That could change over the next three days with major headlines expected out of the Fed, Fed meeting and Janet Yellen Speech, and economic reports, GDP, and ADP and Monthly Unemployment Report.

Traders should have established a long position or two as leading growth stocks started bouncing off moving averages and use quick shake outs as opportunities to enter new positions unless recent positions start triggering initial or tightened stops. If this is real, leading growth stocks will keep following through on recent gains. Otherwise, keep tight stops to protect from more serious losses if the rally attempt fails.

TRADING IDEAS

Lannett Co (LCI) has appreciated almost 1,000% in just over a year after breaking out of a cup and handle base in January 2014. The stock is currently attempting to shape a third stage cup shape base and is starting to breakout from the bottom of its base.

Jazz Pharmaceuticals (JAZZ), after almost tripling since breaking out of a cup and handle base in May 2013, is now in the process of forming a second stage cup shaped base. The stock has setup to move up the right side of the cup shaped base.

Leading growth stocks finally outperformed and started to round up cup shaped bases and add to recent gains. Zillow (Z) which failed its cup and handle base breakout just two day ago, broke back above the original pivot point in higher, well above average volume. Smith and Wesson (SWHC) broke out of a cup and handle base, and Western Refining (WNR) followed through on its cup and handle breakout Monday. Skechers (SKX) and Apple (AAPL) added to their break away gaps on earning's reports.

Reviewing the trading action over the last two weeks, there have been some scary days and a lot of shakeouts, but little distribution. Price volume favors a continuation of this rally. The only missing piece is more follow through by leading growth stocks bouncing off moving averages. That could change over the next three days with major headlines expected out of the Fed, Fed meeting and Janet Yellen Speech, and economic reports, GDP, and ADP and Monthly Unemployment Report.

Traders should have established a long position or two as leading growth stocks started bouncing off moving averages and use quick shake outs as opportunities to enter new positions unless recent positions start triggering initial or tightened stops. If this is real, leading growth stocks will keep following through on recent gains. Otherwise, keep tight stops to protect from more serious losses if the rally attempt fails.

TRADING IDEAS

Lannett Co (LCI) has appreciated almost 1,000% in just over a year after breaking out of a cup and handle base in January 2014. The stock is currently attempting to shape a third stage cup shape base and is starting to breakout from the bottom of its base.

Jazz Pharmaceuticals (JAZZ), after almost tripling since breaking out of a cup and handle base in May 2013, is now in the process of forming a second stage cup shaped base. The stock has setup to move up the right side of the cup shaped base.

Monday, April 28, 2014

US Stock Market Update and Trading Ideas: SouFun (SFUN) and Smith and Wesson (SWHC)

Traders heads are spinning. What started off as a promising day, quickly turned into a major reversal and potential distribution day, only to reverse and close near the highs of the day in heavy, above average volume.

Leading growth stocks seemed headed for another disastrous day in heavy volume but managed to close off the lows. Most are still within their consolidations trying to turn higher, but few have managed to do so. Western Refining (WNR) broke out and Smith and Wesson (SWHC) is on the verge of breaking out of cup and handle bases.

This could be an interesting week. With leading growth stocks failing to completely breakdown and three potentially major market moving headlines, on Wednesday, Fed Meeting announcement, Thursday, Janet Yellen speaks, and Friday's Monthly Unemployment report, the market and leading growth stocks could tighten and attempt to rally. Not time to go fishing yet!!

TRADING IDEAS

Soufun Holdings (SFUN) is bouncing off the two hundred day moving average for the second time in two weeks. The stock is in the process of rounding the bottom of a cup shaped base. Price and volume have been fairly orderly considering this would be a third stage consolidation. The stock could be entered as it tries to bounce back through the two hundred day moving average with a stop below the consolidation lows.

Smith and Wesson (SWHC) is just shy of breaking out a cup and handle base. The stock is up over 500% since the end of 2011 and this would be a late stage consolidation more prone to failure. A breakout above $15.10 could launch the stock towards its pe expansion target of between $17 and $20.

Leading growth stocks seemed headed for another disastrous day in heavy volume but managed to close off the lows. Most are still within their consolidations trying to turn higher, but few have managed to do so. Western Refining (WNR) broke out and Smith and Wesson (SWHC) is on the verge of breaking out of cup and handle bases.

This could be an interesting week. With leading growth stocks failing to completely breakdown and three potentially major market moving headlines, on Wednesday, Fed Meeting announcement, Thursday, Janet Yellen speaks, and Friday's Monthly Unemployment report, the market and leading growth stocks could tighten and attempt to rally. Not time to go fishing yet!!

TRADING IDEAS

Soufun Holdings (SFUN) is bouncing off the two hundred day moving average for the second time in two weeks. The stock is in the process of rounding the bottom of a cup shaped base. Price and volume have been fairly orderly considering this would be a third stage consolidation. The stock could be entered as it tries to bounce back through the two hundred day moving average with a stop below the consolidation lows.

Smith and Wesson (SWHC) is just shy of breaking out a cup and handle base. The stock is up over 500% since the end of 2011 and this would be a late stage consolidation more prone to failure. A breakout above $15.10 could launch the stock towards its pe expansion target of between $17 and $20.

Friday, April 25, 2014

US Market Update and Trading Ideas -- Tesla Motors (TSLA) and Air Lease (AL)

If it was not clear we were still in a correction, today left no doubt. The market opened lower and sold off relentlessly for the remainder of the day, closing down over one percent. Volume was lower, but that was little consolation.

Leading growth stocks took the brunt of the punishment, selling off significantly in heavier volume. But, as bad as the selling was, it was within the boundaries of recent consolidations. Leading growth stocks continue to work on consolidations that will potentially need a few weeks to complete and tighten. There are several stocks that are further along in their consolidations and could be ready sooner.

Short trading ideas Rackspace Hosting (RAX), Lions Gate Entertainment (LGF), Walter Investment Management (WAC), and Wolverine World Wide (WWW) began breaking down or rolling over, and CommVault System (CVLT) gapped down around 30% on a poor earning's report. Even after today's sell off, there are still short trading ideas ready to break down if the market continues lower. A failure to breakdown with the market could be a sign of underlying strength in the market.

After a major sell off in the market and among leading growth stocks, long traders are better off patiently observing the market for the next day or two before venturing back in, or risk a death by a thousand cuts. Short traders have to keep tight stops. Market's recent history of retracing moves quickly, warrants tighter profit taking stops as shorts follow through and the market gets stretched down. Otherwise, cash is not a bad place to be mentally for an unbiased weekend review.

TRADING IDEAS

Tesla Motors (TSLA) is testing the upper channel line of a down trend that the stock cleared in slight above average volume on April 22nd. If the stock manages to hold and turn higher, it could attempt to breakout towards new fifty two week highs. Earnings are expected May 7th.

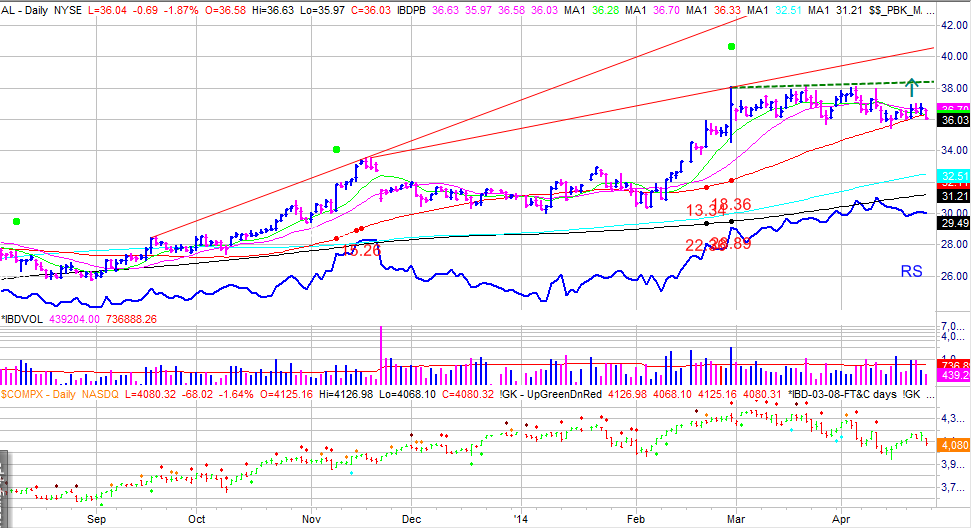

Air Lease (AL) continues to build a flat base. The stock has managed to close tight for most of the consolidation, including two three week tight bases within the flat base, and hold above the fifty day moving average. A breakout above the recent consolidation could clear the way for a flat base breakout above $38. Earnings are expected May 8th.

Leading growth stocks took the brunt of the punishment, selling off significantly in heavier volume. But, as bad as the selling was, it was within the boundaries of recent consolidations. Leading growth stocks continue to work on consolidations that will potentially need a few weeks to complete and tighten. There are several stocks that are further along in their consolidations and could be ready sooner.

Short trading ideas Rackspace Hosting (RAX), Lions Gate Entertainment (LGF), Walter Investment Management (WAC), and Wolverine World Wide (WWW) began breaking down or rolling over, and CommVault System (CVLT) gapped down around 30% on a poor earning's report. Even after today's sell off, there are still short trading ideas ready to break down if the market continues lower. A failure to breakdown with the market could be a sign of underlying strength in the market.

After a major sell off in the market and among leading growth stocks, long traders are better off patiently observing the market for the next day or two before venturing back in, or risk a death by a thousand cuts. Short traders have to keep tight stops. Market's recent history of retracing moves quickly, warrants tighter profit taking stops as shorts follow through and the market gets stretched down. Otherwise, cash is not a bad place to be mentally for an unbiased weekend review.

TRADING IDEAS

Tesla Motors (TSLA) is testing the upper channel line of a down trend that the stock cleared in slight above average volume on April 22nd. If the stock manages to hold and turn higher, it could attempt to breakout towards new fifty two week highs. Earnings are expected May 7th.

Air Lease (AL) continues to build a flat base. The stock has managed to close tight for most of the consolidation, including two three week tight bases within the flat base, and hold above the fifty day moving average. A breakout above the recent consolidation could clear the way for a flat base breakout above $38. Earnings are expected May 8th.

Thursday, April 24, 2014

Market Frustrating Traders Inter day Volatility High

A one percent higher opening on the back of strong earning's reports from Apple (AAPL) and Facebook (FB), turned into a major sell off in higher volume at the opening bell. But by ten o'clock, the market found its footing and slowly retraced about half the morning losses over the next hour, and traded in a tight range for the remainder of the day, closing higher in heavier volume. What could have turned into follow through day if the early gains held, turned into a stalling day by the close.

Leading growth stocks just can't seem to get out of their own way. Most remain near the bottoms of their consolidations trying to round higher, but none have managed to break higher. Even stocks that resisted the correction and have advanced into new highs, have not made much progress and volume leaves little to be desired. But, as long as leading growth stocks are able to hold these consolidations, they can withstand another wave of index selling without breaking apart.

This market is a trader's worst nightmare. Neither side, long or short, can follow through without a major shakeout threatening and/or derailing the new trend attempt. Tight stops keep getting hit, but, proving to be the right move. Traders must keep positions light and stopped tight. Allow positions to get stopped out on tight stops, and hold those that do not. Protecting from major losses in case the correction resumes, and still being invested if the rally continues. It's never easy...ever!

TRADING IDEAS

Baidu (BIDU) broke out from a bottoming cup and handle base in July of 2013 and appreciated over eighty percent. A recent breakout attempt out of a faulty v-shaped, sloppy cup and handle base, in well above average volume, failed. The stock is now in the process of forming the bottom of a cup shaped base ahead of earnings tonight, April 24th. A breakaway gap could appreciate to fifty two week highs. Caution is warranted, recent gap ups have been quite volatile.

Walter Investment Management (WAC) broke down from a head and shoulder pattern at the beginning of the year and declined over thirty percent. The past two months the stock has pulled back to its fifty day moving average, in low volume, for the first time since breaking down. The stock has stalled at the moving average three times and has been rolling over despite the market's recent rally attempt. Earnings are expected May 8th.

Leading growth stocks just can't seem to get out of their own way. Most remain near the bottoms of their consolidations trying to round higher, but none have managed to break higher. Even stocks that resisted the correction and have advanced into new highs, have not made much progress and volume leaves little to be desired. But, as long as leading growth stocks are able to hold these consolidations, they can withstand another wave of index selling without breaking apart.

This market is a trader's worst nightmare. Neither side, long or short, can follow through without a major shakeout threatening and/or derailing the new trend attempt. Tight stops keep getting hit, but, proving to be the right move. Traders must keep positions light and stopped tight. Allow positions to get stopped out on tight stops, and hold those that do not. Protecting from major losses in case the correction resumes, and still being invested if the rally continues. It's never easy...ever!

TRADING IDEAS

Baidu (BIDU) broke out from a bottoming cup and handle base in July of 2013 and appreciated over eighty percent. A recent breakout attempt out of a faulty v-shaped, sloppy cup and handle base, in well above average volume, failed. The stock is now in the process of forming the bottom of a cup shaped base ahead of earnings tonight, April 24th. A breakaway gap could appreciate to fifty two week highs. Caution is warranted, recent gap ups have been quite volatile.

Walter Investment Management (WAC) broke down from a head and shoulder pattern at the beginning of the year and declined over thirty percent. The past two months the stock has pulled back to its fifty day moving average, in low volume, for the first time since breaking down. The stock has stalled at the moving average three times and has been rolling over despite the market's recent rally attempt. Earnings are expected May 8th.

Wednesday, April 23, 2014

Market Keeps Traders On Edge Stay Alert

Considering the five day rally attempt and yesterday's surge in higher volume, today's sell off in lower volume is healthy action to digest those gains. The Nasdaq traded steadily down most of the day and the SP 500 traded in a wide sideways range.

Leading growth stocks were mainly unimpressive, under performing the market the entire day. Stocks in the Oil and Gas sector were the only leading growth stocks that manged to rise in reasonable volume. Synergy Resources (SYRG) added gains to it cup and handle breakout on Monday, Matador Resources (MTDR), Silica Holdings (SLCA), and Concho Resources (CXO) continued recent strong action into new highs in above average volume. Most other leading growth stocks sold off in mixed volume. The good news, the majority remain within consolidations, rounding and trying to tighten recent volatility.

Short trading ideas refuse to breakdown except for a few that gapped down on poor reactions to earning's reports. Cree Inc (CREE) gapped down below the neckline of it head and shoulders pattern and International Game Technologies (IGT) bounced off its twenty day moving average in heavy, above average volume.

Traders once again find themselves in a tough situation trying to determine how much to tighten stops on recent long positions and whether or not to start initiating shorts. The best course of action is to keep portfolio's light and under leveraged until stocks can prove that they can breakout/breakdown, and hold the first scary pullback. Until then, traders are forced to protect capital with tighter then normal stops. Even if that means being shaken out.

TRADING IDEAS

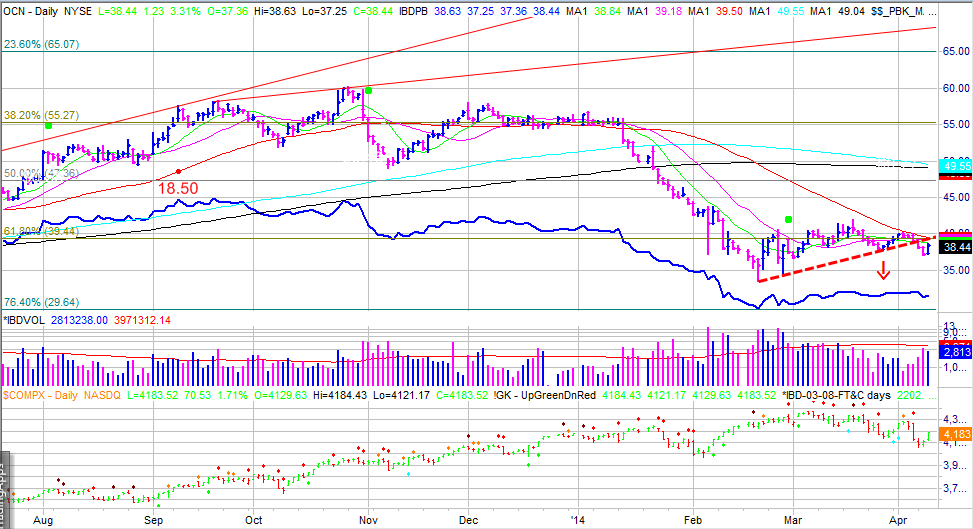

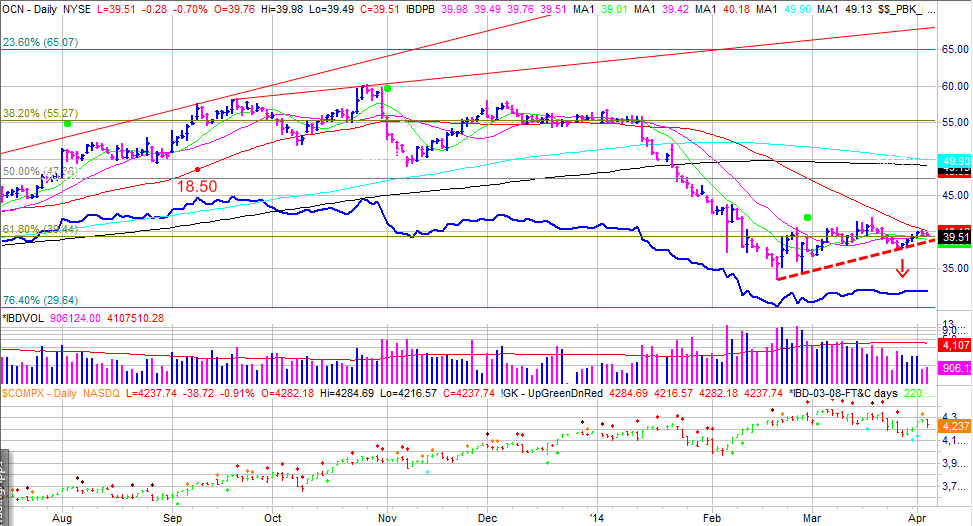

Ocwen Financial (OCN) continues to trade along the fifty day moving average trying to rollover towards fifty two week lows. The stock recently tested the fifty day moving average and previous short term trend line in lower, below average volume.

Taser International (TASR) is working up the right side of its double bottom base on top of a previous cup and handle base. The stock is set to report earnings next Wednesday, April 30th, and could pause to form a handle at the intersection of a down trend line and the previous handles breakout level. A breakout above the intersection or $19.73 mid point could set the stock up for another run into fifty two week highs.

Leading growth stocks were mainly unimpressive, under performing the market the entire day. Stocks in the Oil and Gas sector were the only leading growth stocks that manged to rise in reasonable volume. Synergy Resources (SYRG) added gains to it cup and handle breakout on Monday, Matador Resources (MTDR), Silica Holdings (SLCA), and Concho Resources (CXO) continued recent strong action into new highs in above average volume. Most other leading growth stocks sold off in mixed volume. The good news, the majority remain within consolidations, rounding and trying to tighten recent volatility.

Short trading ideas refuse to breakdown except for a few that gapped down on poor reactions to earning's reports. Cree Inc (CREE) gapped down below the neckline of it head and shoulders pattern and International Game Technologies (IGT) bounced off its twenty day moving average in heavy, above average volume.

Traders once again find themselves in a tough situation trying to determine how much to tighten stops on recent long positions and whether or not to start initiating shorts. The best course of action is to keep portfolio's light and under leveraged until stocks can prove that they can breakout/breakdown, and hold the first scary pullback. Until then, traders are forced to protect capital with tighter then normal stops. Even if that means being shaken out.

TRADING IDEAS

Ocwen Financial (OCN) continues to trade along the fifty day moving average trying to rollover towards fifty two week lows. The stock recently tested the fifty day moving average and previous short term trend line in lower, below average volume.

Taser International (TASR) is working up the right side of its double bottom base on top of a previous cup and handle base. The stock is set to report earnings next Wednesday, April 30th, and could pause to form a handle at the intersection of a down trend line and the previous handles breakout level. A breakout above the intersection or $19.73 mid point could set the stock up for another run into fifty two week highs.

Tuesday, April 22, 2014

US Market Outlook - Indices Surge in Heavier Volume NYSE A/D Line Confirms Rally Attempt

After last Tuesday's (4/15) high volume reversal, after being down almost ten percent for the correction, the Nasdaq had rallied for three straight days, but on anemic, and some of the lowest volume levels of the year. Throwing suspicion on its attempted rally. The DOW and SP 500 on the other hand are just under one percent from fifty two week and all time highs, with volume running right around, or above average, confirming the strength of their rally attempts. The bifurcation in volume and performance is no surprise, the Nasdaq has been lagging significantly for the better part of the past two month as the DOW and SP 500 have continued their rallies.

Today, all three indices had strong up moves in heavier volume. A slight late day bout of selling kept the Nasdaq from following through and confirming the rally. The NYSE advance/decline is confirming the rally as it had moved into new high ground several days ago while the market was trying to find a bottom.

Value stocks have been the clear leaders over the past two months, while most leading growth stocks are near the bottoms of their corrections attempting to round up or bounce off moving averages. There are a handful of setups among leading growth stocks ready to move higher. The stocks that have started to bounce, did so in heavier, above average volume. Zillow (Z) followed through on its cup and handle breakout from yesterday, Synaptics (SYNA) broke out from a pullback to the fifty day moving average, Baidu (BIDU) continued to follow through on its bounce off the two hundred day moving average and up the right side of a cup shaped based ahead of earnings Thursday, Netflix (NFLX) and Centene Corp. (CNC) gapped up on well received earning's reports, and Rambus (RMBS) reversed higher after initially selling off on it earning's report.

Short setups have been a big disappointment. Even as the Nasdaq corrected just short of ten percent, very few were able to breakdown and follow through. Most just squeezed back into their consolidations after attempting to breakdown, but few have fallen apart and rallied much higher. If they continue to hold consolidations despite a market rally, it could be the first sign of weakness with the current rally.

It is a rare occurrence for the DOW and SP 500 to lead the market, but not unprecedented. Generally when these two indexes lead, rallies last anywhere from a few days/weeks, up to around four months (DOW and SP 500 have been rallying since February 5th, almost 3 months), but can be profitable in a select group of stocks, and it typically occurs as the market approaches an intermediate or major top. Generally growth stocks will lag, except for the strong few that failed to correct the most along with the previous pullback. The rest will usually attempt to bounce off major moving averages, only to fail as they approach fifty two week highs or shorter term moving average above.

Interestingly enough, this period reminds me of February to May of 2006 when the DOW followed through on February 14th and didn't look back until the entire market finally rolled over into the summer correction on May 10, 2006. This was the last rally wave of a major leg of that bull market that started in August of 2004. The Nasdaq at that time struggled to make new highs, and by the time it managed to get to fifty two week highs, the rest of the market was within 9 days of topping. The current DOW and SP followed through around February 11th and barely pulled back while the Nasdaq corrected almost ten percent. Based on this, Sell in May and go away might just be a good strategy unless the Nasdaq and leading growth stocks mange to setup and take over leading the market, but that would most likely require another major shake out period as the Nasdaq approached the fifty day moving average or a major correction as leading growth stocks approach fifty two week highs.

Traders should have been entering a few long trades over the last two days with tight stops. The expectations are for stocks to break out or bounce higher and keep moving higher. If too many start to turn back, the rally attempt could be in trouble very quickly and traders would be prudent to protect their portfolios from even small losses. Short trades have likely stopped most traders out, but short setups have to be monitored closely as most are still holding within their overall consolidations and could re tighten to roll over if the rally attempt runs into trouble over the next few days or weeks. The last 3 months have been tough for traders to make a lot of progress with every pull back threatening to turn into a major correction and every rally attempt failing to follow through.

TRADING IDEAS

Air Lease Corporation (AL) has been pulling back to its fifty day moving average while the Nasdaq corrected just under ten percent. The stock has formed a flat base and is in a position to bounce off the fifty day moving average and attempt a breakout above the $38 pivot point. Relative strength rose into new highs for most of the correction. Aggressive traders could begin taking a position as the stock follows through off the fifty day moving average.

Magnum Hunter Resources (MHR) finds itself in one of the hottest sectors in the market, oil and gas. The stock ran up over 100% after breaking out above the two hundred day moving average last August. Earnings estimates are negative, but the company has beaten them handily the past two quarters. Sales growth is expected to accelerate over the next three quarters to 77% and grow 35% over the next three years. The stock is forming a cup and handle base on top of a previous double bottom. A breakout above the handle around $9.10, could launch the stock to all time highs, clearing all remaining resistance.

Today, all three indices had strong up moves in heavier volume. A slight late day bout of selling kept the Nasdaq from following through and confirming the rally. The NYSE advance/decline is confirming the rally as it had moved into new high ground several days ago while the market was trying to find a bottom.

Value stocks have been the clear leaders over the past two months, while most leading growth stocks are near the bottoms of their corrections attempting to round up or bounce off moving averages. There are a handful of setups among leading growth stocks ready to move higher. The stocks that have started to bounce, did so in heavier, above average volume. Zillow (Z) followed through on its cup and handle breakout from yesterday, Synaptics (SYNA) broke out from a pullback to the fifty day moving average, Baidu (BIDU) continued to follow through on its bounce off the two hundred day moving average and up the right side of a cup shaped based ahead of earnings Thursday, Netflix (NFLX) and Centene Corp. (CNC) gapped up on well received earning's reports, and Rambus (RMBS) reversed higher after initially selling off on it earning's report.

Short setups have been a big disappointment. Even as the Nasdaq corrected just short of ten percent, very few were able to breakdown and follow through. Most just squeezed back into their consolidations after attempting to breakdown, but few have fallen apart and rallied much higher. If they continue to hold consolidations despite a market rally, it could be the first sign of weakness with the current rally.

It is a rare occurrence for the DOW and SP 500 to lead the market, but not unprecedented. Generally when these two indexes lead, rallies last anywhere from a few days/weeks, up to around four months (DOW and SP 500 have been rallying since February 5th, almost 3 months), but can be profitable in a select group of stocks, and it typically occurs as the market approaches an intermediate or major top. Generally growth stocks will lag, except for the strong few that failed to correct the most along with the previous pullback. The rest will usually attempt to bounce off major moving averages, only to fail as they approach fifty two week highs or shorter term moving average above.

Interestingly enough, this period reminds me of February to May of 2006 when the DOW followed through on February 14th and didn't look back until the entire market finally rolled over into the summer correction on May 10, 2006. This was the last rally wave of a major leg of that bull market that started in August of 2004. The Nasdaq at that time struggled to make new highs, and by the time it managed to get to fifty two week highs, the rest of the market was within 9 days of topping. The current DOW and SP followed through around February 11th and barely pulled back while the Nasdaq corrected almost ten percent. Based on this, Sell in May and go away might just be a good strategy unless the Nasdaq and leading growth stocks mange to setup and take over leading the market, but that would most likely require another major shake out period as the Nasdaq approached the fifty day moving average or a major correction as leading growth stocks approach fifty two week highs.

Traders should have been entering a few long trades over the last two days with tight stops. The expectations are for stocks to break out or bounce higher and keep moving higher. If too many start to turn back, the rally attempt could be in trouble very quickly and traders would be prudent to protect their portfolios from even small losses. Short trades have likely stopped most traders out, but short setups have to be monitored closely as most are still holding within their overall consolidations and could re tighten to roll over if the rally attempt runs into trouble over the next few days or weeks. The last 3 months have been tough for traders to make a lot of progress with every pull back threatening to turn into a major correction and every rally attempt failing to follow through.

TRADING IDEAS

Air Lease Corporation (AL) has been pulling back to its fifty day moving average while the Nasdaq corrected just under ten percent. The stock has formed a flat base and is in a position to bounce off the fifty day moving average and attempt a breakout above the $38 pivot point. Relative strength rose into new highs for most of the correction. Aggressive traders could begin taking a position as the stock follows through off the fifty day moving average.

Magnum Hunter Resources (MHR) finds itself in one of the hottest sectors in the market, oil and gas. The stock ran up over 100% after breaking out above the two hundred day moving average last August. Earnings estimates are negative, but the company has beaten them handily the past two quarters. Sales growth is expected to accelerate over the next three quarters to 77% and grow 35% over the next three years. The stock is forming a cup and handle base on top of a previous double bottom. A breakout above the handle around $9.10, could launch the stock to all time highs, clearing all remaining resistance.

Tuesday, April 15, 2014

Little Good News for Bulls Despite Yesterday's Rally

The market finally managed to rally yesterday, unfortunately, volume was well below average, and early week rallies during corrections, and counter trend moves during holiday shortened weeks, tend to be bear traps. The rally attempt was more a result of an over extended market needing to digest its losses, and traders being gun shy after two days of volatile, above average volume selling, needing to take a break.

The Nasdaq officially traded in correction territory, down over eight percent, and is on the verge of undercutting its February lows at 3,968.19, marking the first time since this major leg of the bull market began at the end of 2012, the index undercut two previous lows after breaking out to new highs. The index is in the midst of potentially forming a bearish, broadening tops formation. The good news, there should be another multi month rally after this correction runs its course, to complete the pattern. For now, all the major indices look poised to test their two hundred day moving averages before attempting a serious rally.

Leading growth stocks bounced back along with the market, but quickly turned lower on any market weakness during the trading day. A few stocks are ready to rally further and a handful are managing to follow through to new highs. Unfortunately, the majority need at least a couple of weeks to digest recent volatility and losses, but remain within acceptable correction loss levels, and continue working on new consolidations.

Short ideas have been disappointing. While a few stocks have managed to break down in heavy volume and follow through, most squeeze back quickly with every rally attempt. Holding a short trade longer then a few days, is too risky. There are still setups tightening into moving averages and appear ready to roll over, confirming further weakness with yesterday's rally attempt.

Friday, most of the weekend, and even yesterday, turned out to be great days to take off and recharge after recent heavy, above average volume selling and volatility, especially with the warmer weather. Outside of day trading, most traders are better off in cash until the market tightens up into the next trend, most likely down, based on recent action.

TRADING IDEAS - SHORTS

Ocwen Financial (OCN), featured recently, rolled over at its fifty day moving average and broke down below its trend line in increasing volume, but failed to follow through, squeezing back to test the fifty day moving average and broken trend line over the last four days. Look for the stocks to roll back over and test near fifty two week lows.

Rackspace Hosting (RAX), another recently featured stock, has been slowly rolling over, and is finally threatening to break fifty two week lows. Despite the market rally yesterday, the stock spent the entire day trading lower, displaying major relative weakness. Look for a high volume break of recent support around 30.75.

The Nasdaq officially traded in correction territory, down over eight percent, and is on the verge of undercutting its February lows at 3,968.19, marking the first time since this major leg of the bull market began at the end of 2012, the index undercut two previous lows after breaking out to new highs. The index is in the midst of potentially forming a bearish, broadening tops formation. The good news, there should be another multi month rally after this correction runs its course, to complete the pattern. For now, all the major indices look poised to test their two hundred day moving averages before attempting a serious rally.

Leading growth stocks bounced back along with the market, but quickly turned lower on any market weakness during the trading day. A few stocks are ready to rally further and a handful are managing to follow through to new highs. Unfortunately, the majority need at least a couple of weeks to digest recent volatility and losses, but remain within acceptable correction loss levels, and continue working on new consolidations.

Short ideas have been disappointing. While a few stocks have managed to break down in heavy volume and follow through, most squeeze back quickly with every rally attempt. Holding a short trade longer then a few days, is too risky. There are still setups tightening into moving averages and appear ready to roll over, confirming further weakness with yesterday's rally attempt.

Friday, most of the weekend, and even yesterday, turned out to be great days to take off and recharge after recent heavy, above average volume selling and volatility, especially with the warmer weather. Outside of day trading, most traders are better off in cash until the market tightens up into the next trend, most likely down, based on recent action.

TRADING IDEAS - SHORTS

Ocwen Financial (OCN), featured recently, rolled over at its fifty day moving average and broke down below its trend line in increasing volume, but failed to follow through, squeezing back to test the fifty day moving average and broken trend line over the last four days. Look for the stocks to roll back over and test near fifty two week lows.

Rackspace Hosting (RAX), another recently featured stock, has been slowly rolling over, and is finally threatening to break fifty two week lows. Despite the market rally yesterday, the stock spent the entire day trading lower, displaying major relative weakness. Look for a high volume break of recent support around 30.75.

Thursday, April 10, 2014

Leading Growth Stocks Crushed Market Sets New Correction Lows Take Friday Off

The low volume rally attempt over last two days was suspicious, and the market confirmed that today, selling off over 2% in heavy, above average volume. The market opened slightly down, and sold off relentlessly for the entire trading day, barely able to catch its breathe. Clearly not the action bulls wanted to see.

Leading growth stocks were so weak, the bears couldn't even muster trapping the bulls, fake breaking out the few setups that were ready, during the little, early strength. Only a handful of leading growth stocks are still holding tight, with the rest in need of a few weeks to digest the heavy selling. At least, none are in bearish patterns, worrying us about a bear market, and continue within normal correction levels.

After today's carnage, tomorrow, Friday, is a good day to take off, and start a long weekend to digest the erratic trading action over the last three weeks. Don't worry about missing any trading activity. Clearing our minds is more valuable then a day of stressful, potentially profitable trading. Outside of a day trade, cash is an excellent position, shorts are a risky position, and longs are just suicidal in this market over the next few days. Seriously, take a long weekend to unwind, and come back next week ready to put together a battle plan for the next rally, after the correction. Prepare!!

Review recent blogs, leading stock analysis, and short ideas, for all our thoughts and trading ideas over the past few weeks.

Recent Blogs - Click to Read

Leading Stock Analysis - Click to Review

Short Ideas - Click to Review

Leading growth stocks were so weak, the bears couldn't even muster trapping the bulls, fake breaking out the few setups that were ready, during the little, early strength. Only a handful of leading growth stocks are still holding tight, with the rest in need of a few weeks to digest the heavy selling. At least, none are in bearish patterns, worrying us about a bear market, and continue within normal correction levels.

After today's carnage, tomorrow, Friday, is a good day to take off, and start a long weekend to digest the erratic trading action over the last three weeks. Don't worry about missing any trading activity. Clearing our minds is more valuable then a day of stressful, potentially profitable trading. Outside of a day trade, cash is an excellent position, shorts are a risky position, and longs are just suicidal in this market over the next few days. Seriously, take a long weekend to unwind, and come back next week ready to put together a battle plan for the next rally, after the correction. Prepare!!

Review recent blogs, leading stock analysis, and short ideas, for all our thoughts and trading ideas over the past few weeks.

Recent Blogs - Click to Read

Leading Stock Analysis - Click to Review

Short Ideas - Click to Review

Wednesday, April 09, 2014

Rally Attempt Continues Volume Dries Up

The market followed through on yesterday's reversal, opening higher, and rallying for the remainder of the day. Closing up over one percent, and near the highs of the day. Unfortunately, volume was lighter, and below average, throwing early suspicion on the rally attempt.

For the second day in a row, leading growth stocks outperformed in above average volume. Few have been able to break out to new highs, but many are attempting to break through, or bounce off moving averages. Some setups remain, but the risk is increasing of a shakeout, especially, if the market has another big up day.

Good chance short positions have been stopped out to protect profits or prevent from larger losses. Like leading growth stocks, few short idea setups have broken apart, most continue to consolidate within their potential setup zones.

Aggressive traders who entered long positions over the last two trading days, should have small profit cushions. With leading growth stocks making little progress, even after today's strong gains, traders should be on a short trigger to tighten stops, but also on the lookout for strength on shakeouts to add new positions. If volume begins to dry up as leading growth stocks bounce off moving average or increase with no meaningful appreciation (stalling), chances are, another shake out is brewing over the next week or two. Not enough evidence yet to force taking profits and moving to cash.

TRADING IDEAS

Energy XXI (EXXI) continue to try and roll over at the fifty day moving average. The stock continues to tighten into the fifty day moving average in lower volume. Look for a break down below the recent down trend line. The stock could drop over 25% to the next support level around $16.

Ocwen Financial (OCN) rolled over from the fifty day moving average the last few days as volume increases. The stock has paused, and shuffling sideways toward the fifty day moving average in lower volume. A reversal back down, could finally break the stock lower towards fifty two week lows.

For the second day in a row, leading growth stocks outperformed in above average volume. Few have been able to break out to new highs, but many are attempting to break through, or bounce off moving averages. Some setups remain, but the risk is increasing of a shakeout, especially, if the market has another big up day.

Good chance short positions have been stopped out to protect profits or prevent from larger losses. Like leading growth stocks, few short idea setups have broken apart, most continue to consolidate within their potential setup zones.

Aggressive traders who entered long positions over the last two trading days, should have small profit cushions. With leading growth stocks making little progress, even after today's strong gains, traders should be on a short trigger to tighten stops, but also on the lookout for strength on shakeouts to add new positions. If volume begins to dry up as leading growth stocks bounce off moving average or increase with no meaningful appreciation (stalling), chances are, another shake out is brewing over the next week or two. Not enough evidence yet to force taking profits and moving to cash.

TRADING IDEAS

Energy XXI (EXXI) continue to try and roll over at the fifty day moving average. The stock continues to tighten into the fifty day moving average in lower volume. Look for a break down below the recent down trend line. The stock could drop over 25% to the next support level around $16.

Ocwen Financial (OCN) rolled over from the fifty day moving average the last few days as volume increases. The stock has paused, and shuffling sideways toward the fifty day moving average in lower volume. A reversal back down, could finally break the stock lower towards fifty two week lows.

Tuesday, April 08, 2014

Over Extended Market Attempting New Rally Too Early To Call

As the market bounced around in the morning, leading growth stocks managed to hold, consolidate sideways until the market started to rally firmly around 10:30 EST, and started breaking out of intra-day, day trading patterns, outperforming the market for the first time in over a week, in heavy, above average volume. Most of these stocks are setup or setting up in potential long, short term swing trading patterns, with a few potentially leading to bigger gains if the rally attempt gains steam. Oil stocks, Continental Resources (CLR) followed through on recent strength to new highs, while Concho Resources (CXO) and Silica Holdings (SLCA) are within striking distance.

Short ideas that have broken down and followed through, consolidated their recent gains, but, it would've been preferred that the shorts continued to follow through despite the market's rally attempt, to maintain a higher level of confidence in them. Coal stocks, Alpha Natural Resources (ANR) and Walter Energy (WLT) were the worst squeezed stocks on the short ideas list. Closing up over five percent, in heavy, above average volume.

Aggressive traders should have been initiating a long trade or two, while simultaneously tightening stops on any remaining short positions, just in case the rally attempt gains steam. If not, the initial risk is low, one to three percent, verse the potential profit of five to ten percent. Even during a weak rally attempt.

Otherwise, more conservative investors would be better suited waiting another day or two to see if today's gains hold and follow through. There will be at least one or two shake outs with new setups along the way, if the rally attempt strengthens.

Most setups are off or below moving averages, not near fifty two week highs, which is a sign that the rally attempt has a high probability of being choppy and short lived, and the market's recent history of changing trends on a dime, should keep traders defensive with new positions. Just remember, the earlier breakouts tend to be the easiest to hold, but not the only ones to go on to big gains, and trend changes, whether sudden or slow, are never mentally easy to navigate. The key is always for leading growth stocks to breakout, from short or long term consolidations, and hold above breakout levels during the first few shakeouts. If not, the likelihood of more downside increases dramatically, and traders would be forced to protect themselves from their long positions, and looking for new short trading ideas.

THE SETUPS

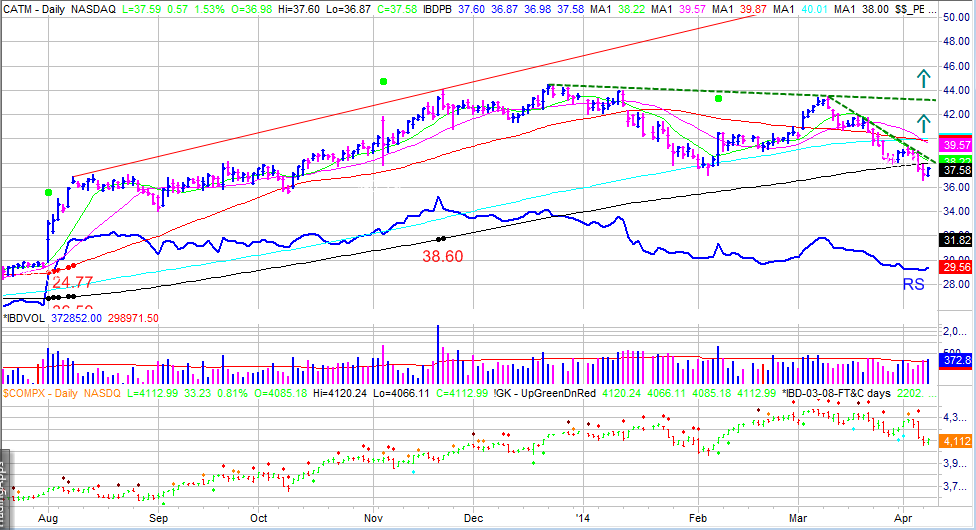

Cardtronics (CATM) rose 50% in just under five months after breaking out of a first stage cup and handle base, in August of 2013, on a positive reaction to an earning's report. The last four months have been spent consolidating those gains, and working on a double bottom base. Look for a breakout above the recent downtrend as the stock climbs up the right side of the double bottom base, or the mid point of the double bottom base, around $43.50. The overall structure and price volume action is very bullish.

NVR (NVR) was the only home builder that broke out and followed through during the last trade able rally. The stock broke out of a one year cup and handle base, in well above average volume, and advanced just short of 20% in a few days. Ever since, the stock has been forming a flat base, digesting those gains in lower volume, as the fifty day moving average catches up. Setting the stage for another run higher. Look for a breakout above the trend line or recent tight range.

Short ideas that have broken down and followed through, consolidated their recent gains, but, it would've been preferred that the shorts continued to follow through despite the market's rally attempt, to maintain a higher level of confidence in them. Coal stocks, Alpha Natural Resources (ANR) and Walter Energy (WLT) were the worst squeezed stocks on the short ideas list. Closing up over five percent, in heavy, above average volume.

Aggressive traders should have been initiating a long trade or two, while simultaneously tightening stops on any remaining short positions, just in case the rally attempt gains steam. If not, the initial risk is low, one to three percent, verse the potential profit of five to ten percent. Even during a weak rally attempt.

Otherwise, more conservative investors would be better suited waiting another day or two to see if today's gains hold and follow through. There will be at least one or two shake outs with new setups along the way, if the rally attempt strengthens.

Most setups are off or below moving averages, not near fifty two week highs, which is a sign that the rally attempt has a high probability of being choppy and short lived, and the market's recent history of changing trends on a dime, should keep traders defensive with new positions. Just remember, the earlier breakouts tend to be the easiest to hold, but not the only ones to go on to big gains, and trend changes, whether sudden or slow, are never mentally easy to navigate. The key is always for leading growth stocks to breakout, from short or long term consolidations, and hold above breakout levels during the first few shakeouts. If not, the likelihood of more downside increases dramatically, and traders would be forced to protect themselves from their long positions, and looking for new short trading ideas.

THE SETUPS

Cardtronics (CATM) rose 50% in just under five months after breaking out of a first stage cup and handle base, in August of 2013, on a positive reaction to an earning's report. The last four months have been spent consolidating those gains, and working on a double bottom base. Look for a breakout above the recent downtrend as the stock climbs up the right side of the double bottom base, or the mid point of the double bottom base, around $43.50. The overall structure and price volume action is very bullish.

NVR (NVR) was the only home builder that broke out and followed through during the last trade able rally. The stock broke out of a one year cup and handle base, in well above average volume, and advanced just short of 20% in a few days. Ever since, the stock has been forming a flat base, digesting those gains in lower volume, as the fifty day moving average catches up. Setting the stage for another run higher. Look for a breakout above the trend line or recent tight range.

Monday, April 07, 2014

Another Major Day of Selling Solidifies Correction

If Friday's high volume distribution was not clear enough, today's heavy volume selling nailed home that the rally is dead, and the market is back in correction. Outside of an early morning rally attempt, the market spent a second day in a row, selling off in heavy volume, and closing down over one percent.

Leading growth stocks, which managed to hold up well during the first wave of selling off the March 6th high, have started to break key moving averages in higher, above average volume, suffering a second major day of heavier selling. While the short term technical picture looks ugly, long term, leading growth stocks are still within acceptable correction levels, holding longer term trend lines and support levels, and several are still holding up well despite the broad based selling.

Short ideas resumed leading the market lower. Many managed to hold tight during the market's rally attempt over the previous few days, but have started to roll over in higher, above average volume on Friday. Recently discussed short ideas, Pier 1 Imports (PIR) and Ocwen Financial (OCN), rolled over at their fifty day moving averages and are following through to the downside. There are still a few stocks positioned to roll over, but the risk of a short squeeze increases as the market falls further below its moving averages.

Once again, all signs point to a deeper correction, but every time the market and leading growth stocks have looked this way, they have managed to settle down after a few days of heavy selling and setup the next leg higher. So now is not the time to go fishing yet. The next few rally attempts will tell us if leading growth stocks will setup up properly to lead higher, or end up in more bearish patterns like the head shoulders top, double top, punch bowl of death, etc., and roll over further. This process could take a few weeks to a few months, presenting several trading opportunities.

As discussed in recent blogs, when value leads growth, rally attempts tend to be choppier and short lived, so stops should have been tightened to protect from taking major losses on newly initiated positions and profits on existing positions. Long traders should have been stopped out on Friday, since almost not a single stock managed to hold above recent breakout points or support levels. Aggressive short traders had an initial opportunity on Friday to enter a position or two on the short side, and another opportunity today on the early morning rally attempt. Long traders should continue to track leading growth stocks resisting the downside pressure.

THE SETUPS

Rackspace Hosting (RAX) was one of the first stocks to breakout after the market bottomed in 2009. The stock ran up over 400% in just under four years, and has spent the last year and a half setting up a head shoulder top. Its recent attempts to test the fifty day moving average have stalled and come in lower volume. A breakdown below recent support levels could see the stock drop below $30, and possibly closer to the next support level around $25. Buyout rumors do continuously circulate around the stock, so shorting it is riskier, but each rumor has been met with selling after an initial gap up.

Resmed (RMD) has been forming a head and shoulder top for the better part of a year now. The stock has spent the last two months testing the fifty day moving average in lower volume. A breakdown below recent support, should see the stock trade down to at least the next support level around $40.

Leading growth stocks, which managed to hold up well during the first wave of selling off the March 6th high, have started to break key moving averages in higher, above average volume, suffering a second major day of heavier selling. While the short term technical picture looks ugly, long term, leading growth stocks are still within acceptable correction levels, holding longer term trend lines and support levels, and several are still holding up well despite the broad based selling.

Short ideas resumed leading the market lower. Many managed to hold tight during the market's rally attempt over the previous few days, but have started to roll over in higher, above average volume on Friday. Recently discussed short ideas, Pier 1 Imports (PIR) and Ocwen Financial (OCN), rolled over at their fifty day moving averages and are following through to the downside. There are still a few stocks positioned to roll over, but the risk of a short squeeze increases as the market falls further below its moving averages.

Once again, all signs point to a deeper correction, but every time the market and leading growth stocks have looked this way, they have managed to settle down after a few days of heavy selling and setup the next leg higher. So now is not the time to go fishing yet. The next few rally attempts will tell us if leading growth stocks will setup up properly to lead higher, or end up in more bearish patterns like the head shoulders top, double top, punch bowl of death, etc., and roll over further. This process could take a few weeks to a few months, presenting several trading opportunities.

As discussed in recent blogs, when value leads growth, rally attempts tend to be choppier and short lived, so stops should have been tightened to protect from taking major losses on newly initiated positions and profits on existing positions. Long traders should have been stopped out on Friday, since almost not a single stock managed to hold above recent breakout points or support levels. Aggressive short traders had an initial opportunity on Friday to enter a position or two on the short side, and another opportunity today on the early morning rally attempt. Long traders should continue to track leading growth stocks resisting the downside pressure.

THE SETUPS

Rackspace Hosting (RAX) was one of the first stocks to breakout after the market bottomed in 2009. The stock ran up over 400% in just under four years, and has spent the last year and a half setting up a head shoulder top. Its recent attempts to test the fifty day moving average have stalled and come in lower volume. A breakdown below recent support levels could see the stock drop below $30, and possibly closer to the next support level around $25. Buyout rumors do continuously circulate around the stock, so shorting it is riskier, but each rumor has been met with selling after an initial gap up.

Resmed (RMD) has been forming a head and shoulder top for the better part of a year now. The stock has spent the last two months testing the fifty day moving average in lower volume. A breakdown below recent support, should see the stock trade down to at least the next support level around $40.

Thursday, April 03, 2014

One Day Makes A Big Difference Rally Attempt Under Pressure But Not Dead

The market tried to rally early, but started selling off around ten o'clock, barely stopping to squeeze, and closing near the lows of the day, in lower volume. A late day rally attempt and the lower volume, took some of the sting, out of the bite, but an already shaky foundation, doesn't need anymore weight on it so soon with poor price action. Tomorrow's Monthly Job's Report will most likely determine direction over the next few days, but be prepared for a potential shake out of this rally attempt and a reversal, otherwise the rally could be done as quickly as it started.

Leading growth stocks took the biggest hit, selling off significantly in higher volume. Many remain within their consolidations and above recent pivot points, but another bad day could lead to failing breakouts and short term consolidations breaking apart, requiring at least a few days to digest and set up again. Long term, leading growth stocks could still fall further without jeopardizing longer term trends. Several stocks did resist the selling pressure, Silica Holdings (SLCA), Lithia Motors (LAD), and Matador Resources (MTDR) added to recent gains, in higher volume.

Today is exactly the type of day traders did not want to see, so soon after a rally attempt. Market was weak, thankfully in lower volume, but barely, with a complete inability to sustain a bounce, and leading growth stocks lagged all day, unable to muster any strength to resist the selling pressure. Traders should be getting stopped out of newer long positions and tightening stops on existing, well behaving positions to protect profits, moving away from or to lower margin levels. Be prepared to buy back, this has all the characteristics of a potential shake out. Most leading growth stocks continue unbroken, and are still in fairly tight recent consolidations ahead of tomorrow's Monthly Job's Report. We should have a better idea of trend, by noon tomorrow, hopefully. Review the trading ideas below and our short ideas list for more short setups and leading growth stock analysis for more long setups.

TRADING IDEAS

Pier 1 Import (PIR) has been lagging the market all year. The stock has been consolidating into the fifty day moving average, in low volume, and slowly rolling over the last few days despite the market rally. A failed rally attempt would bring heavier selling into the stock, potentially trading down to around $16, the next major level of support.

Ocwen Financial (OCN) has been one of bull markets biggest winners, but has acted poorly since breaking down from a head and shoulder pattern at the beginning of the year. The stock has recently paused to digest those losses, pulling back to the fifty moving average in below average volume. The stock has failed to participate in the current rally attempt and looks ready to roll back over to fifty two week lows.

PS: Comments always welcome, even if they disagree. :o)

Leading growth stocks took the biggest hit, selling off significantly in higher volume. Many remain within their consolidations and above recent pivot points, but another bad day could lead to failing breakouts and short term consolidations breaking apart, requiring at least a few days to digest and set up again. Long term, leading growth stocks could still fall further without jeopardizing longer term trends. Several stocks did resist the selling pressure, Silica Holdings (SLCA), Lithia Motors (LAD), and Matador Resources (MTDR) added to recent gains, in higher volume.

Today is exactly the type of day traders did not want to see, so soon after a rally attempt. Market was weak, thankfully in lower volume, but barely, with a complete inability to sustain a bounce, and leading growth stocks lagged all day, unable to muster any strength to resist the selling pressure. Traders should be getting stopped out of newer long positions and tightening stops on existing, well behaving positions to protect profits, moving away from or to lower margin levels. Be prepared to buy back, this has all the characteristics of a potential shake out. Most leading growth stocks continue unbroken, and are still in fairly tight recent consolidations ahead of tomorrow's Monthly Job's Report. We should have a better idea of trend, by noon tomorrow, hopefully. Review the trading ideas below and our short ideas list for more short setups and leading growth stock analysis for more long setups.

TRADING IDEAS

Pier 1 Import (PIR) has been lagging the market all year. The stock has been consolidating into the fifty day moving average, in low volume, and slowly rolling over the last few days despite the market rally. A failed rally attempt would bring heavier selling into the stock, potentially trading down to around $16, the next major level of support.

Ocwen Financial (OCN) has been one of bull markets biggest winners, but has acted poorly since breaking down from a head and shoulder pattern at the beginning of the year. The stock has recently paused to digest those losses, pulling back to the fifty moving average in below average volume. The stock has failed to participate in the current rally attempt and looks ready to roll back over to fifty two week lows.

PS: Comments always welcome, even if they disagree. :o)

Wednesday, April 02, 2014

Market and Leading Growth Stocks Digest Two Day Surge in Lower Volume Further Upside Remains

After a two day, higher volume surge, the market opened flat and traded flat, with a slight downward bias, closing modestly higher after a late day rally materialized. Volume came in lower and below average, exactly the type of action traders are looking for to confirm the rally attempt remains healthy. The market still needs to pass the test and continue rallying strongly over the next day or two.

Leading growth stocks continued to follow through on recent breakouts, but many spent the day lagging the general market, digesting recent gains in lower volume. Setups continue to develop and are ready to breakout and follow through. There has been little to no negative action since the market bottomed, March 27th. GasLog (GLOG), Silica Holdings (SLCA), and Concho Resources (CXO) continued to follow through on recent gains, and Lithia Motors (LAD) broke out of a double bottom with a handle base, volume was lower then expected for a strong breakout.

Today's action further confirmed the rally's health. After surging for two days, the market and leading growth stock paused in lower volume and setup the next round of potential breakouts. Another quick shakeout can be expected before the Monthly Job's Report on Friday, but traders should be accumulating long positions, and ready to initiate new positions, on short shallow pullbacks on any given day.

TRADING IDEAS

Tesla Motors (TSLA) broke out of third stage, cup shaped base in heavy volume and advanced over forty percent in under a month. The stock has since been pulling back to the fifty day moving average in lower volume, setting up a potential final climax run. A breakout above the recent down trend line should launch the stock higher.

Air Lease (AL), discussed several times in past blogs, continues to setup a flat base pullback to the twenty day moving average. A breakout above thirty eight dollars, should advance the stock another ten to twenty percent.

Leading growth stocks continued to follow through on recent breakouts, but many spent the day lagging the general market, digesting recent gains in lower volume. Setups continue to develop and are ready to breakout and follow through. There has been little to no negative action since the market bottomed, March 27th. GasLog (GLOG), Silica Holdings (SLCA), and Concho Resources (CXO) continued to follow through on recent gains, and Lithia Motors (LAD) broke out of a double bottom with a handle base, volume was lower then expected for a strong breakout.

Today's action further confirmed the rally's health. After surging for two days, the market and leading growth stock paused in lower volume and setup the next round of potential breakouts. Another quick shakeout can be expected before the Monthly Job's Report on Friday, but traders should be accumulating long positions, and ready to initiate new positions, on short shallow pullbacks on any given day.

TRADING IDEAS

Tesla Motors (TSLA) broke out of third stage, cup shaped base in heavy volume and advanced over forty percent in under a month. The stock has since been pulling back to the fifty day moving average in lower volume, setting up a potential final climax run. A breakout above the recent down trend line should launch the stock higher.

Air Lease (AL), discussed several times in past blogs, continues to setup a flat base pullback to the twenty day moving average. A breakout above thirty eight dollars, should advance the stock another ten to twenty percent.

Tuesday, April 01, 2014

Market and Leading Growth Stocks Surge Over 1% in Higher Volume Confirming Rally Attempt

For the second day in a row, the Nasdaq gapped and closed up over one percent in higher volume, while the Standard and Poor's 500 and New York Stock Exchange closed at new all time highs, further confirming the recent rally attempt.

Leading growth stocks out performed for the second straight day, following through to fifty two week highs and bouncing off major moving averages in higher volume. New setups develop daily and intra day market shake outs have had little effect and are over come by the close with ease, closing at the highs of the day. ARM Holdings (ARMH) and US Silica Holdings (SLCA) followed through on yesterday's breakouts, and Zulily Inc (ZU), YY (YY), and Taser International (TASR) bounced off their fifty day moving averages.

The past two days have left no doubt that the market rally attempt is for real, leading growth stocks are breaking out, bouncing off major moving averages, following through in above average volume, and holding firm during any shakeout attempts. Traders should be out of all short positions and accumulating long positions, especially during intra-day shakeout attempts.

TRADING IDEAS

Insys Therapeutics (INSY) more then doubled in price, in less then two months, after bouncing off the fifty day moving average at the beginning of the year. The stock has spent the past five week consolidating into the fifty day moving average in lower volume. A breakout attempt above the recent down trend could propel the stock back to fifty two week highs.

Taser International (TASR) more then tripled in price since breaking out of a first stage, cup and handle base in October 2012. The stock has spend the last six months consolidating sideways, forming a flat base pullback to the fifty day moving average, on top of another flat base. Today, the stock bounced off the fifty day moving average and pullback to the down trend line the stock broke above March 25th in heavy volume, and still within a buy able range.

Leading growth stocks out performed for the second straight day, following through to fifty two week highs and bouncing off major moving averages in higher volume. New setups develop daily and intra day market shake outs have had little effect and are over come by the close with ease, closing at the highs of the day. ARM Holdings (ARMH) and US Silica Holdings (SLCA) followed through on yesterday's breakouts, and Zulily Inc (ZU), YY (YY), and Taser International (TASR) bounced off their fifty day moving averages.

The past two days have left no doubt that the market rally attempt is for real, leading growth stocks are breaking out, bouncing off major moving averages, following through in above average volume, and holding firm during any shakeout attempts. Traders should be out of all short positions and accumulating long positions, especially during intra-day shakeout attempts.

TRADING IDEAS

Insys Therapeutics (INSY) more then doubled in price, in less then two months, after bouncing off the fifty day moving average at the beginning of the year. The stock has spent the past five week consolidating into the fifty day moving average in lower volume. A breakout attempt above the recent down trend could propel the stock back to fifty two week highs.

Taser International (TASR) more then tripled in price since breaking out of a first stage, cup and handle base in October 2012. The stock has spend the last six months consolidating sideways, forming a flat base pullback to the fifty day moving average, on top of another flat base. Today, the stock bounced off the fifty day moving average and pullback to the down trend line the stock broke above March 25th in heavy volume, and still within a buy able range.

Subscribe to:

Posts (Atom)