If it was not clear we were still in a correction, today left no doubt. The market opened lower and sold off relentlessly for the remainder of the day, closing down over one percent. Volume was lower, but that was little consolation.

Leading growth stocks took the brunt of the punishment, selling off significantly in heavier volume. But, as bad as the selling was, it was within the boundaries of recent consolidations. Leading growth stocks continue to work on consolidations that will potentially need a few weeks to complete and tighten. There are several stocks that are further along in their consolidations and could be ready sooner.

Short trading ideas Rackspace Hosting (RAX), Lions Gate Entertainment (LGF), Walter Investment Management (WAC), and Wolverine World Wide (WWW) began breaking down or rolling over, and CommVault System (CVLT) gapped down around 30% on a poor earning's report. Even after today's sell off, there are still short trading ideas ready to break down if the market continues lower. A failure to breakdown with the market could be a sign of underlying strength in the market.

After a major sell off in the market and among leading growth stocks, long traders are better off patiently observing the market for the next day or two before venturing back in, or risk a death by a thousand cuts. Short traders have to keep tight stops. Market's recent history of retracing moves quickly, warrants tighter profit taking stops as shorts follow through and the market gets stretched down. Otherwise, cash is not a bad place to be mentally for an unbiased weekend review.

TRADING IDEAS

Tesla Motors (TSLA) is testing the upper channel line of a down trend that the stock cleared in slight above average volume on April 22nd. If the stock manages to hold and turn higher, it could attempt to breakout towards new fifty two week highs. Earnings are expected May 7th.

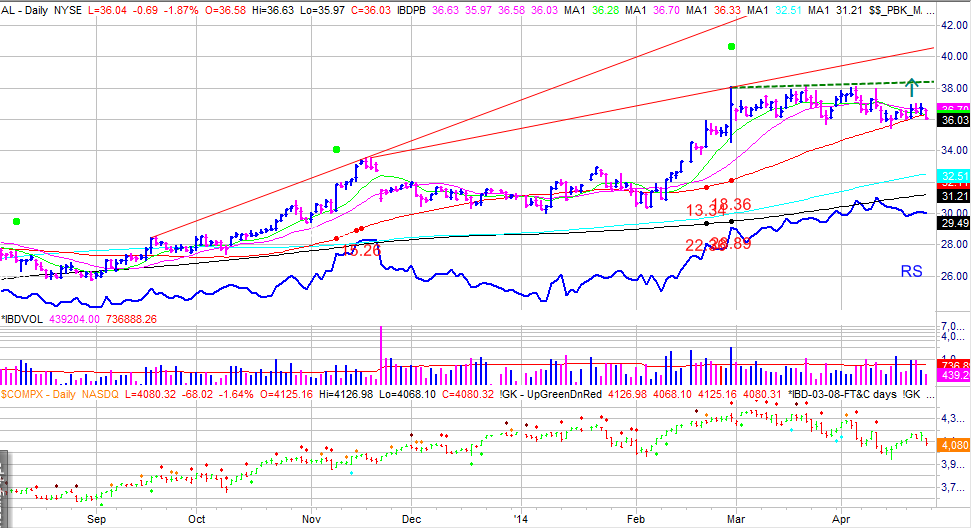

Air Lease (AL) continues to build a flat base. The stock has managed to close tight for most of the consolidation, including two three week tight bases within the flat base, and hold above the fifty day moving average. A breakout above the recent consolidation could clear the way for a flat base breakout above $38. Earnings are expected May 8th.

Leading growth stocks took the brunt of the punishment, selling off significantly in heavier volume. But, as bad as the selling was, it was within the boundaries of recent consolidations. Leading growth stocks continue to work on consolidations that will potentially need a few weeks to complete and tighten. There are several stocks that are further along in their consolidations and could be ready sooner.

Short trading ideas Rackspace Hosting (RAX), Lions Gate Entertainment (LGF), Walter Investment Management (WAC), and Wolverine World Wide (WWW) began breaking down or rolling over, and CommVault System (CVLT) gapped down around 30% on a poor earning's report. Even after today's sell off, there are still short trading ideas ready to break down if the market continues lower. A failure to breakdown with the market could be a sign of underlying strength in the market.

After a major sell off in the market and among leading growth stocks, long traders are better off patiently observing the market for the next day or two before venturing back in, or risk a death by a thousand cuts. Short traders have to keep tight stops. Market's recent history of retracing moves quickly, warrants tighter profit taking stops as shorts follow through and the market gets stretched down. Otherwise, cash is not a bad place to be mentally for an unbiased weekend review.

TRADING IDEAS

Tesla Motors (TSLA) is testing the upper channel line of a down trend that the stock cleared in slight above average volume on April 22nd. If the stock manages to hold and turn higher, it could attempt to breakout towards new fifty two week highs. Earnings are expected May 7th.

Air Lease (AL) continues to build a flat base. The stock has managed to close tight for most of the consolidation, including two three week tight bases within the flat base, and hold above the fifty day moving average. A breakout above the recent consolidation could clear the way for a flat base breakout above $38. Earnings are expected May 8th.

No comments:

Post a Comment