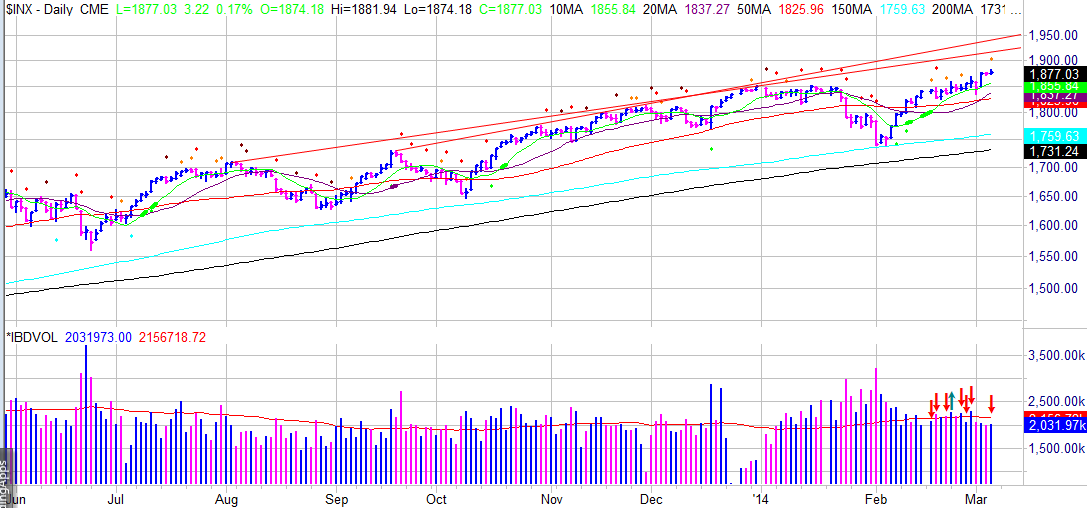

The market is making a bad habit out of stalling and stalling like action over the last two weeks (volume higher, but very little progress is made). The indices started off fairly strong but stalled around noon, and selling accelerated around one o'clock to close mixed and near the lows of the day, a standard pattern recently. There was no clear news to account for the sudden bout of selling, but statements from President Obama on Ukraine and Fed's Lockhart that the bar should be set high for the Fed to change tapering course, contributed to an already jittery market.

Leading growth stocks lagged significantly for a second straight day. While a few like Baidu (BIDU), which broke out of a faulty v-shaped cup and handle, and Chipotle Mexican Grill (CMG) and VipShops (VIPS) added to recent gains, the remainder have started to stall and show signs of weakness and breaking down.

Valeant Pharmaceutical (VRX) and Gilead Sciences (GILD) which were holding fairly tight, sliced through their 20 day moving averages on higher, above average volume. Actavis (ACT) has started to trade a lot wider and looser, and is reversing off fifty two week highs, on heavy volume, after going on a potential climax run on a buyout of Forest Labs (FRX) and a strong earning's report. Jazz Pharmaceuticals (JAZZ), a leader and big winner since the middle of 2013, reversed off fifty two week highs on the heaviest volume since its initial breakout, and is now threatening to slice through its fifty day moving average.

Markets can top on the way up and this market is basically grinding higher at this point. While some stocks will manage to keep moving higher, many will stall and start selling off, well before the market. Long traders have very little to do except to day trade and wait for a pull back. Short traders should be prepared to start accumulating positions as leading growth stocks participate less and short idea stocks start to break down.

SHORT IDEAS - THE SETUP

CommVault Systems (CVLT) ran up over 500% since the bull market began in 2009. But for the past year, the stock has been forming a head should pattern. In January the stock gapped down below its neck line in heavy volume on a poor reaction to an earning's report. Since then, the stock has spent the last five weeks pulling up to the 50 day moving average and its neck line on lower volume. Look for a breakdown below the recent trend line to carry the stock under $60.

Leading growth stocks lagged significantly for a second straight day. While a few like Baidu (BIDU), which broke out of a faulty v-shaped cup and handle, and Chipotle Mexican Grill (CMG) and VipShops (VIPS) added to recent gains, the remainder have started to stall and show signs of weakness and breaking down.

Valeant Pharmaceutical (VRX) and Gilead Sciences (GILD) which were holding fairly tight, sliced through their 20 day moving averages on higher, above average volume. Actavis (ACT) has started to trade a lot wider and looser, and is reversing off fifty two week highs, on heavy volume, after going on a potential climax run on a buyout of Forest Labs (FRX) and a strong earning's report. Jazz Pharmaceuticals (JAZZ), a leader and big winner since the middle of 2013, reversed off fifty two week highs on the heaviest volume since its initial breakout, and is now threatening to slice through its fifty day moving average.

Markets can top on the way up and this market is basically grinding higher at this point. While some stocks will manage to keep moving higher, many will stall and start selling off, well before the market. Long traders have very little to do except to day trade and wait for a pull back. Short traders should be prepared to start accumulating positions as leading growth stocks participate less and short idea stocks start to break down.

SHORT IDEAS - THE SETUP

CommVault Systems (CVLT) ran up over 500% since the bull market began in 2009. But for the past year, the stock has been forming a head should pattern. In January the stock gapped down below its neck line in heavy volume on a poor reaction to an earning's report. Since then, the stock has spent the last five weeks pulling up to the 50 day moving average and its neck line on lower volume. Look for a breakdown below the recent trend line to carry the stock under $60.

No comments:

Post a Comment