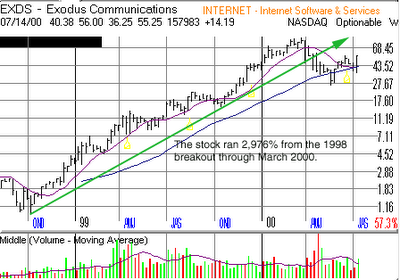

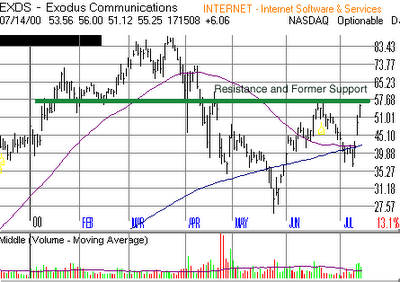

This was one of the hottest stocks from October 1998 through March of 2000. The stock ran 2,976% in that time period, before peaking in Mid March 2000. As the Nasdaq dropped nearly 40%, EXDS crashed 70%. Since then the stock has managed to recover some of its losses but is still well below its all time high. So is this the time to buy?

Looking at the chart pattern, I can't say anything positive about this once upon on a time leader. Some investors would say the stock is in the process of forming the handle of a cup and handle pattern, but I beg to differ. One, the stock is still running into resistance at its mid level of 57 1/2, and second, the stock needs to be closer to its high. However, if the stock were to move through 58 on a short term basis, it may rally to 65, it's next resistance level. After that the stock may run into more resistance at 73 and 85, as disgruntled investor who bought at the peak, start to unload their shares at the first chance to break even.

If the stock can continue to 85 or just below, and consolidate their for a few weeks, then I would call it a cup and handle, and be looking for a breakout on high volume to new highs.

Investors can put their alerts at 57 1/2 for a potential breakout to the next level, but keeping their stops 7% below their purchase price, as this stock is very volatile, and I'm not yet convinced that it can make it to the top to form a handle, just yet.

No comments:

Post a Comment