Friday, June 24, 2005

Market Letter

Hold onto the stronger stocks as one distribution day won't kill themarket, but definitely getting rid of the laggards. This is a goodtime to start looking for new setups. It seems we will need onemore down to sideways week to allow for proper bases to setup in thestronger stocks. Some are already setup just waiting for a signalfrom the market.

Oil reached $60 a barrel, but it almost seems that a double top hasnow formed. If these levels are sustained the market will needsometime to digest which would mean that a summer correction in themarkets is 90% likely, unless oil retreats away from $60/barrel.What will the market be looking for? How will oil in the $60'seffect the economy. $50's didn't hurt. But will the $60's?

Even if we do start a correction here, we'll probably see anotherweek or two rally somewhere during earnings season. If this is thecase and the rally is weak, then even the strongest of stocks needto be examined even closer, and possibly sold. For now, just getrid of the laggards.

Only time will tell, for now better get safe then sorry.

Wednesday, May 18, 2005

Market Letter

I found something very interesting while doing my research the lasttwo days. Retail and hotel/motel REITs, retailers, and other consumercompanies are either at or near 52 weeks highs. If the economy isdoing so poorly why are these stocks moving higher. Is it possiblethat the market is signaling better times ahead as it usually does?I'd say yes. As long as there is a Republican President the mediawill continue to try and convince you that the economy is heading intorecession. But the market knows better.

Don't let your opinions keep you on the sidelines. If this marketweakens for some reason, I'll let you know. For now, do your researchand get involved. But don't take my word for it, just look at theprice volume action of the market, especially the NASDAQ, which isleading index at this point.

Remember, always protect your capital first.

Tuesday, May 17, 2005

Market Letter

I've heard a lot about buying homebuilders for the long term orinvesting in real estate in hot markets. If you're one those peopleI would strongly reconsider. The homebuilders are looking extremelyweak on their charts and look like they are topping. Talk to anyreal estate professional who's willing to give you a true assessmentof the market, and they will tell you that things aren't looking asgreat as things seem. Prices are getting away from most people'scomfort and affordability range. Most of the buying is being doneby investors and by homeowners who already own 2+ properties. Takeinto account that on every market news channel you have oneanalyst/real estate professional after another telling you this timeit's different and we are in a paradigm shift, and shivers shouldstart to creep down your neck. Think back to the stock market in1999 and 2000, they were saying the same thing about stocks. Therest eventually was history as we all know.

Learn from history, it repeats itself, more then you think.

Wednesday, May 04, 2005

Market Outlook

Sunday, May 01, 2005

Market Letter

1. Sentiment has been highly bearish over the last several weeks.

2. The NASDAQ under cut 1900 and traders began to panic.

3. Oil is under $50 a barrel and prob has topped, again barring anyunforeseen turmoil in the Middle East.

4. Top rated stocks with high growth have begun to breakout out ofbases and hold their breakout points. Other stocks are close tofinishing up their bases.

5.The reversal on Friday came on heavy volume.

6. Earnings are coming in well above expectations and guidance hasbeen good.

7. Softer economic data recently may be signaling that the Fed hasdone their job and interest rates maybe close to topping in the nextmonth or two.

The market may be seeing better times on the horizon. Remember,recent bad news is already built in and the market moves on futureexpectations ( 6 - 8 months outward). Typically, things look theworst at the bottom and the best at the top.

We may still go lower but not by much. I would have preferred theDOW to undercut 10K on Friday to really set off even more panic.

To get a firm confirmation that this rally will hold, we will need astrong up day sometime after Tuesday of next week on heavier volumethen the previous day and no more high volume sell off days.

This leg up won't be the best one, but it is a start. Once morestocks setup and breakout, the market will then have the ammo toreally make a move.

Nothing is 100%. Cut your losses short, and if the market starts toget distributed next week, get off margin as we may actually need tosee the DOW under 10K before we could go higher.

Wednesday, March 16, 2005

Market Letter

Anyone who has been around me since beginning ofJanuary knows that I turned bearish and have been since then. Therally that went on in February was led by energy and basic materialstocks. These sectors do not lead market rallies for too long, theyjust don't have the long term growth rates necessary. If you paidattention to the price volume action of theindexes you would've noticed that the down days kept coming in inhigher volume then the up days. The NASDAQ which was the lastindex to show a follow through, followed through too late, andcouldn't mke any headway passed it's 50DMA. Leading stocks, whatleading stocks. That's right, right now there are none. Energy andbasic material stocks cannot lead a rally for too long, they justdon't have the long term growth rates necessary.

If you're not out of your long positions by now, make sure you keep areal close eye on them. If they are down significantly don't beafraid to take profit or the loss. Once the market gets some legsagain, there will be plenty of opportunities.

Monday, December 20, 2004

Market Letter

The rest of this week and month should see a decrease in tradingactivity as Wall Street prepares for Christmas and New Years.There's not much as far as earnings until the second week ofJanuary, when earnings season will begin.

A reader asked about NAVR, and immediately tried to justify why itshould be bought right now because of fundamentals. Pastfundamental performance is meaningless if the stock is headinglower. The market only cares what the fundamentals will look like6 - 8 months from now. Estimates might look good, but the smartmoney knows better then to look at estimates available to thegeneral public. They have their own team of analyst doing theresearch, and that's the research you'll never see. All I see is astock with good fundamentals but poor technicals. The stock triedto breakout of a late stage consolidation (base), and quicklyfailed. The failure could be due to the market having difficultygoing higher. But, the stock sliced though it's 50 DMA on heavyvolume, and hasn't been able to recover back above it. At thispoint, I would at least take some profits off the table, and keep atight watch over the next few days and weeks on the stocks technicalaction. If you're not in it, then wait for it to setup again, rightnow the risk/reward isn't in your favor considering the technicalaction of the stock and market.

You might be thinking that the estimates and data available is useless. By themselves I would say yes. Combined with technicals,it allows you to get a clearer picture of what the smart moneyknows. Are the technicals always right? No. But our job is tominimize our risk, and maximize our gain. We will miss some of thebig runs, but we will also avoid some of the big sell offs, savingus allot of money in the end. Remember, 100% gain, can be wiped outby 50% loss. So it's easier to lose your money, than make it.

If you want a good example of how using only fundamentals would'vefailed big time, just look back to 2000 when the bubble burst.Every stock that was absolutely getting creamed, fundamentallylooked like they were going to be the next CSCO or MSFT. But, justlike clockwork, 6 - 8 months later most of those companies startedto report problems with their fundamental picture going forward.

Saturday, December 04, 2004

Market Letter

A reader asked me about SIRI and AMX. SIRI is an interesting stock,but a highly speculative one. If you owned it before the suddenmove up, great, but to buy it now would be exposing yourself to toomuch risk. AMX is a great stock. It has it all, fundamentals andtechnicals, but the best time to have bought the stock was back inOctober. The stock will move with the market. It's ok to buy thestock here since it has paused, but I would be out quick if themarket starts to sell off hard or the stock gives you sell signals.Otherwise, it should be a good one as long the market is still inbull mode, may have power to $70 or above.

Monday, November 29, 2004

Market Letter

All bull markets pause to consolidate and shake off the froth. Thisweek brings alot of big economic reports. GDP, oil inventories, andpayroll numbers. Any of these numbers can jolt the market one wayor another. If you've noticed the action in the market, you've seenthe market gap up and come in almost regularly on these reports,similar action to the bull run of last year. This type of actiontends to suppress the speculation in the market, and allow it tomove in a steady fashion. But, speculation can't be held backforever, and once it is unleashed, that final run is usually a signof a top to come. My point is, in a gap up opening, be careful ininitiating long positions that day, as they might quickly reverse onyou. Best times to buy, is a flat opening, or a down opening and areversal into positive territory.

Keep looking for breakouts as leading stocks continue to consolidatewell, as the market takes a breather. If my assumptions arecorrect, the market should continue to move higher through the firstquarter of next year. But keep an eye on it, conditions can changein as little as one week.

Wednesday, November 24, 2004

Market Update

Wednesday, November 01, 2000

October Market Update

The market did an about face around the middle of the month when the Consumer Price index (the "CPI") failed to confirm the inflation picture that the PPI portrayed. It became evident that the PPI's spike was caused mainly by the increase in oil and cigarette prices. Intel, after dropping the earnings bomb on the market early on, had an upbeat meeting with analysts, introducing the new family of chips, stating that their 4th quarter will be strong, and that they don't see any Y2K slowdowns in their business. To top it off, the final economic indicators, the GDP, came in at a strong 4.8%, and the two inflationary indicators, GDP chain deflator and employment cost index, came in below expectations, confirming that the economy continues to experience good growth with low inflation. The good economic news sent the long bond yield down to 6.2%, adding the third component that the stock market likes, lower interest rates.

The month ahead will be a challenging one. Y2K is still a major issue on the minds of investors, and any hint that it may cause disruptions could cause another market downturn. The Employment Payroll Report, which shows job growth and increases in hourly wages, will be an important one on the 5th of November. The PPI on the 10th and the CPI on the 17th will be closely watched, especially after the 1.1% spike by the PPI in October. The Federal Reserve Committee meeting on the 16th is the all-important date. We will find out the Fed's plans for interest rates going forward. The consensus seems to be that the Fed will raise rates by 25 basis points. And of course some more earnings, but they'll be secondary drivers.

Monday, August 07, 2000

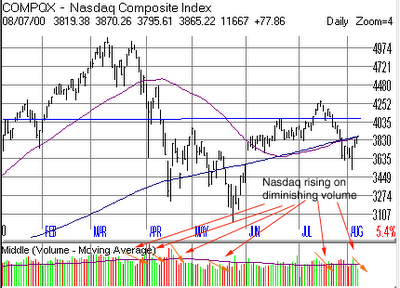

Markets - What a Wedgie

All three major indexes, DOW, NASDAQ, & S&P have been wedging higher. That is, rising while volume has been drying up. What does this mean to you? Even though the markets have been rising, the conviction of institutions to fully commit has been lacking. Without them, the current rally doesn't stand a chance.

Also interesting, the short ratio topped out almost at the same time the market started to rally in early June. Enforcing the idea that the current rally was nothing more then a short squeeze. The bull/bear and put/call ratios also never saw the extremes that these ratio exhibits when firm bottoms are made, and the DOW and NASDAQ are below their 200 day moving averages.

Also interesting, the short ratio topped out almost at the same time the market started to rally in early June. Enforcing the idea that the current rally was nothing more then a short squeeze. The bull/bear and put/call ratios also never saw the extremes that these ratio exhibits when firm bottoms are made, and the DOW and NASDAQ are below their 200 day moving averages.

Right now is a good time to be cautious. There are a lot of contrarian indicators pointing to further declines in the markets, but look for upcoming economic numbers to potentially add fuel to this rally. The market should rally strong if the economic numbers are good. If they don't, then put the red flag up, and start waving it.

The market has now entered it's worst three months of the year. If the past is any indication, then don't look for this current rally to materialize into anything more then a bear trap.

I have one prediction. If this rally is a bear trap and the market does sell off, look for a bottom to be put in late August or early September. Why? Everyone is on to the fact that the market has bottomed in October for the past few years. I believe that these people will sell off their holdings earlier in anticipation of the bottom, and position themselves back in stocks earlier to try and take full advantage of the bottom.

Good Luck!!

If you have to remember anything, remember the following:

Cut you losses short. Let your winners run, not your losers.

Sunday, August 06, 2000

Kulicke & Soffa - KLIC

Looking at the weekly chart below, the stock broke out of a year long cup and handle pattern, and went on to move 124% over the next three months before topping out with the rest of the market in March.

The stock was also part of the strong semiconductor equipment group, which almost every analyst on the street was touting the strong fundamentals, and how the cycle of growth would continue into at least next year. But what do they know?

The stock was also part of the strong semiconductor equipment group, which almost every analyst on the street was touting the strong fundamentals, and how the cycle of growth would continue into at least next year. But what do they know?If you were lucky enough to ride the stock out of the cup and handle, good, but if you didn't get out, you're sitting on a nice loss, bad!!

So how would you have know to get out? Volume wasn't much of a factor in this chart. If you look at the move up or even down early on there wasn't much distribution. The two big days of distribution days on 3/16 and 4/4 were more like accumulation days, as the stock recovered from major sell offs those day to close in the upper range of the day.

Confused yet? Well, good, then your learning that you need to add other sell indicators to your arsenal. In this case the drop below the 50 day moving average on 3/14 should've gotten you out of the stock. If you were stubborn and didn't get out you probably swallowed your heart over the next few days as the stock fell all the way down to 20, the breakout level of the cup and handle pattern, before reversing higher. At that point you were thanking god that the stock began to move higher. The stock proceeded to power through it's 50 day moving average on higher volume. So you thought you were out of the woods, and were able to pick up those cocktail party discussions. Ha!!! Boy were you wrong. The stock continued higher for a few more days but on absolutely no conviction, and then crashed through the 50 day moving average on heavy volume. If you didn't get out here then you were asking for trouble, as the stock tested the $20 level again. At this point a descending triangle began to form. If you at least recognized this bearish pattern forming, you still could've gotten as the stock tested the upper range of the triangle and the 50 day moving average several more times, and failed to break throughor hold above. OK, if you're still in the stock, then the break through the 200 day moving average on 7/21 should've been a final warning that you should take your profit and run.

At this point emotion begins to take over. Traders start to question their selling ability. The most common thought, it's down so far, it can't possibly go lower considering it's in a strong sector. Well, if you were paying attention to the SOX index, you would've realized that the sector the stock was in was on the verge of breaking down itself (Read the 7/31 Stock of The Week, where MB. featured this potential breakdown).

So what's the conclusion? Somebody obviously knew something we didn't know. This was a well orchestrated distribution, as volume didn't clue us in. But the constant breakdown below the 50 day moving average, was a good sign that the institutions were up to no good. This level and the 200 day, are usually where the institutions like to do their buying and selling. So the warning on August 3rd shouldn't have been to much of a surprise. You had plenty of opportunities to get out, hopefully you took them. If not, learn from this experience and don't make the same mistake again.

Good Luck!!

Monday, July 31, 2000

Noven Pharmaceuticals - NOVN

The price inside the handle needs to hold above support at around 23.75 or the whole pattern could be rendered a failure, and may present a shorting opportunity under the support level.

Fundamentally the stock is starting to hit its stride. The company is expected to grow 100% this year, and 65% next year. Its five year projected growth rate is 40%. Analyst have been raising their estimates quite consistantly for the next two quarters and years.

Look for the stock to break the high of its handle at 31.875 before initiating a position. If the stock breaks out on heavy volume and continues higher, it could double rather quickly. But of course, either your stop loss, or the action in the price and volume will guide your sell decision.

Remember: 7% stop losses from your buy point on all trades, or whatever you're comfortable with. Preserve your capital, and you will live to fight another day. Lose it, and back to mutual funds you go.

Sunday, July 30, 2000

Techne Corp. - TECH

Techne Corp. was one of the first stocks to breakout in the most recent rally. If you were lucky enough to get in on the breakout, and get out near the top, you saw your investment appreciate approximately 95% in less then a month.

The stock broke out of a 12+ week base on heavy volume. The handle of the base which lasted about 3+ weeks was a bit sloppy, but the sloppiness came on low volume. If you missed the initial breakout because of the sloppiness, and the sharp move from the bottom of the base through the breakout area, you got a second chance to enter the stock as it paused for about 7 days, and consolidated in a triangle formation. The stock broke out of the triangle on extremely heavy volume and proceeded to around 120, where it paused again to consolidate its move before making its final advance. Up to this point the stock had experienced three distribution days. The first one wasn't concerning as it came right after a big breakout. The second one, again, wasn't to concerning as it too came after a big move. But this one should've raised a cautionary flag, as the volume was extremely heavy. The third distribution day came two days after the second, on above average volume, but nowhere near as heavy as the first two. The stock then proceeded to breakout of that consolidation and head higher on what would be its final run, and the formation of a head and shoulder top. A fourth day of distribution came quite quickly, and on the heaviest volume since the run began, forming the left shoulder. The yellow flag should be up and waving at this point. The run the next day to new high's on just average volume should have put up the red flag. The following day the stock ran up on the open 12 points, only to reverse course and close down 5+ points on extremely heavy volume, forming the head, and logging the fifth day of distribution. This should've been the your final warning, and put up the checkered flag, as this signaled that the stock had run its course, and this was the time to get out, or at least to move up your stop loss to the previous consolidation.

If you were still in the stock at this point, you got another chance to get out with a handsome profit. The stock tried to rally, but the rally came on decreasing volume. Some tried to argue that the volume was above average. But a closer examination would've revealed that it didn't compare to the volume during the rest of the move or the last two distribution days. The sixth day of distribution was then logged, forming the right shoulder and breaking down through the neckline. You could've gotten out at this point, and still would've held on to your profits even if you would have bought the stock as late as the third consolidation in the 120's.

Remember, 4 to 5 distribution days is enough to topple a stock or an index.

Even though the stock has experienced two days recently that look like solid accumulation, big volume spikes on price surges, the stocks relative strength line has broken down. If you read the article on the SOX index, then you know that a breakdown of the relative strength line, is usually a good precursor to what's to come for a stock or index.

If you're still holding the stock, you may be asking for trouble. Those that bought on the first two breakouts still have a profit, everyone else is now sitting on a loss.

Good Luck!!

PMC Sierra - PMCS

This stock has been one of the stocks recently that has broken out on heavy volume, only to breakdown almost immediately.

This stock has been one of the stocks recently that has broken out on heavy volume, only to breakdown almost immediately.The stock had formed a double bottom formation with a handle. The volume during the double bottom formation had acted well. The volume was heavy on the first sell off, then was heavy, but not as heavy as the first sell off, on the second sell off, and the volume in the handle dried up, before the stock broke out on heavy volume.

As is usually common, volatile stocks such as PMCS typically follow the path of the market, and began selling off about two weeks ago, rendering the breakout a failure. But there is short term hope on the horizon.

The stock, as well as the market, are extremely oversold at this point and are due for a technical bounce, also know as a 'dead cat bounce'. The stock is also approaching a critical support line that has dated back to the end of 1998. It has bounced off this support several times, and looks as if it is about to find support there again. One clue I find interesting is that the stock only sold off moderately on Friday as the NASDAQ had its biggest point loss in some time, meaning the selling pressure is moderating.

It would be risky to try and buy the stock before testing the support level, as a dead cat bounce is not guaranteed. Look to enter the stock at around 172, but watch the market on whether or not to reconsider the buy decision. If the market isn't reversing to go higher, avoid the stock, until the market reverses direction to the upside.

If you do enter the trade on the long side, don't overstay your welcome with greed. The stock may try and bounce to the $200 level. Volume will be crucial. If it is declining during the recovery, then your sell signal will be the day the stock undercuts the prior days low. This would be a good point for the high risk trader to initiate a short position.

Remember: 7% stop losses from your buy point on all trades, or whatever you're comfortable with. Preserve your capital, and you will live to fight another day. Lose it, and back to mutual funds you go.

Diamonds - Here's One Your Girlfriend Won't Want

If you're a diamond lover, this article might change your mind. Diamond formations on a chart, particularly an index, are extremely rare. But when they do form they often signal a major bear market on the average of 20% from the breakdown point. The only good thing, the formation has a high failure rate of about 25%.

The DOW has formed a huge one year diamond pattern. The closing price, 10,511, on Friday was right at the breakdown point, and the index was running close to the end of the apex. A breakdown from here would surely send the index tumbling. Its first support level would be around the March low of 9,600, which is also its 50% re-tracement level, measured from its 1998 low to its 2000 high divided by two. This would almost put the index in bear market territory, which the NASDAQ has already seen.

A breakdown below the 50% re-tracement level, would surely put the index firmly into bear market territory, as the bears try and take the index down to the diamond formations average breakdown of 20%, or approximately 8,400 (measured by taking the breakdown level of approximately 10,511 x .80). The index could find support at around 8,775, but it would be weak support.

Tread lightly, as the NASDAQ has come under some selling pressure itself lately. A bounce is likely in the cards for this week as the indexes have experienced some heavy selling over the last week. Any bounce will postpone the diamond breakdown, but watch the volume for clues. If the rally comes on lower volume, and then reverses on a pick in volume, don't stick around to see what happens. Take your profits and run, or short if you can handle it.

Good Luck!!

If you have to remember anything, remember the following:

Cut you losses short. Let your winners run, not your losers.

Thursday, July 27, 2000

Broadcom - BRCM

This stock is a day traders dream. Once it gets going one way or another, there is some serious profits to be made. Unfortunately for BRCM shareholders, the current direction looks down.

The stock broke out of a double bottom formation in late June on heavy volume. But that first day was the only good thing about the breakout. The stock proceeded higher on below average volume, which indicated a lack of interest on the part of the institutions to accumulate the stock.

The stock has now formed a potential head and shoulder top. It is currently sitting right at the neckline. Its relative strength line is on the verge of breaking down. A break below the neckline, under 220, could take the stock under 200, to the breakout level of the double bottom around 188.

The stock is closely related to the SOX index, so if the breakdown in the index is any indication, the stock should follow suit. One important warning, don't overstay your welcome if the market turns up. The reason I say the market, is that even if the stock is weak, a strong market will most likely pull this bad boy higher, and fast. A small profit could turn into a big loss in a blink of an eye. This short is for investor who can watch the stock closely during the day. If you do short BRCM and get stopped out, don't be afraid to re-enter the short again. The market is most likely getting oversold and is due for at least a technical bounce over the next few trading days.

Remember: 7% stop losses from your buy point on all trades, or whatever you're comfortable with. Preserve your capital, and you will live to fight another day. Lose it, and back to mutual funds you go.

Wednesday, July 26, 2000

Advanced Micro Devices - AMD

If you haven't read it yet, then go back and read this weeks stock of the week column on the SOX index and AMAT, before reading today's daily setup. To summarize the article, Mike B. wrote that he thought that the index was on the verge of breaking down, and taking the stocks in it and related to it down with it. Guess what, the index broke down, and many of the related stocks are on the verge of collapse. AMD is one of those stocks.

This stock was one of the only stocks that ran higher during the March/April sell off. At a first glance at the chart, the stock looks like it is forming an upward trending triangle, which is a bullish consolidation. It seems like the stock is trying to digest the big gains made from its run since the end of last October. But if you look at the volume action throughout the consolidation that started back in May, the picture gets outright bearish.

Over the 12+ weeks the stock has been consolidating, it has logged 20 distribution days compared to 6 accumulation days, 5 of which came on pretty lame volume. The other one, on 6/5, the stock tried to breakout on higher volume, could be considered a distribution day as the stock ran up on high volume and closed in the bottom of that days range. Notice also the large amount of spikes in volume on down days. The last six days alone have logged 3 distribution days.

Intel the leader in AMD's category has come under heavy distribution lately too. The report on slowing PC sales, doesn't help the stock either, as its micro processor division makes or breaks the company. The breakdown in the SOX is a further negative and could be the final straw that breaks this camels back.

Anyone who reads Investors Business Daily should've taken notice that even as the stock was approaching its highs, the accumulation/distribution rating, which measures institutional buying or selling interest, was a D, signaling that institutions were unloading their shares. This rating and the volume spikes on down days gave you two of the best clues that the stock was resting only to go lower. It looks like the institutions were unloading the shares while the news was good, and amateur investors were scooping it up not to miss the next leg up. It looks like their not going to enjoy the next leg down as it kicks them in the balls. Maybe the big boys know something we don't. Hmmmmm? Only time will tell.

This stock look like a short under 76.5. The stock is just on the edge of breaking down below its 2 month up-sloping trend line. It actually broke the trend line today on heavy volume, but managed to close just on the border. Look for a continuation move down tomorrow, and enter if you can handle the potential volatility. Conservative short players may want to wait for the stock to take out its July low of 72 1/2, as this level could act as initial support from the trend line breakdown. The next support level is 66, the May low, after that the stock could fall to 61, and finally the 200 day moving average at around 48. Follow the SOX index for clues as to when and where the stock may find a bottom.

Just to let you know, I shorted the stock today at 76 1/2.

Remember: 7% stop losses from your buy point on all trades, or whatever you're comfortable with. Preserve your capital, and you will live to fight another day. Lose it, and back to mutual funds you go.

Tuesday, July 25, 2000

Hewlett Packard - HPQ

Mother Russia is going to be proud of me. Tonight's daily setup, HWP, another one of America's darlings, has set up as a short.

Mother Russia is going to be proud of me. Tonight's daily setup, HWP, another one of America's darlings, has set up as a short.Fundamentally the stock has gotten some bad news from outside itself. The stock sold off on heavy volume on Friday when Agilent warned of a shortfall in earnings for the quarter, and adding to the pressure was the report yesterday showing that PC sales are slowing down.

Technically this chart is just sickening. Ever since the stock peaked on 6/5 it has logged 7 distribution days. 4 of those distribution days came on volume spikes. The last attempt at its high came on waning volume, signaling that the stock maybe tired, and forming the second top in the double top formation. The stock is a short under 115 1/2, which was broken today on heavy volume. The stock also closed below its 50 day moving average, and is pretty close to making a lower low on its relative strength line (it actually made a lower low on the weekly chart below) further enhancing the bearish scenario. An island top will be created, if, over the next several days the stock were to gap down in this area on heavy volume to go along with its gap up on heavy volume on 6/5.

Looking at a longer term chart (see below), there are two major support lines. The stock has been trending higher since the stock bottomed at the end of October last year. During the last sell off, the stock found support, and bounced higher off of this trend line, which corresponded with the stocks breakout out of a cup and handle pattern earlier this year (man those long term charts can be helpful).

Conservative short players may want to cover off the trend line support currently at around 106, unless the stock slices through there on heavy volume. The next stop if that happens is 92 1/2, the area of the cup and handle breakout, and currently around the 200 day moving average. If you do cover at 106, and the stock bounces higher watch the volume. If the bounce comes on low volume then keep your eye on the stock as a possible re-entry short if it breaks the trend line. Also keep in mind that the 200 day moving average is trending higher, and could act as support before the stock reaches 92 1/2.

One more thing. The stock is due to report earnings in early August, so this breakdown in the stock could be a preview of a possibly poor report. But, if the stock starts to show accumulation over the next few days, don't over stay your welcome on the short side.

Just to let you know, I shorted the stock today at 115 1/2.